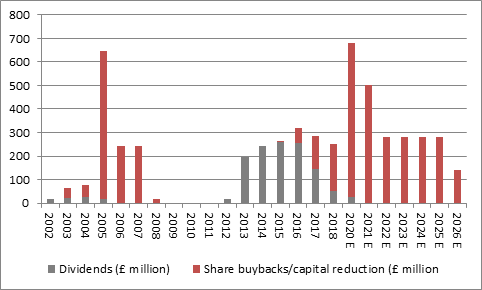

“Berkeley Group has returned £1.7 billion to its shareholders since 2012 via share buybacks and dividend payments and judging by today’s share price gains investors are looking to build fresh positions in the high-end housing expert after the announcement of a plan to top up those cash returns by a further £2.3 billion until September 2025,” says Russ Mould, AJ Bell Investment Director.

“That £2.3 billion cash bonanza represents a £455 million increment on what had already been planned for 2020 and 2021 and equates to a third of the current market value of the company.

“This will be a tempting prospect to many investors, especially those who are seeking steady cash flows from their portfolio at a time when interest rates are hovering near their historic trough and potentially heading lower again.

Source: Company accounts, Sharecast, company cash returns announcement on 22 January 2020. Company fiscal year to April. Assumes all future returns are via buybacks and capital reduction schemes but 2022E-2025E could feature dividends as well as buybacks.

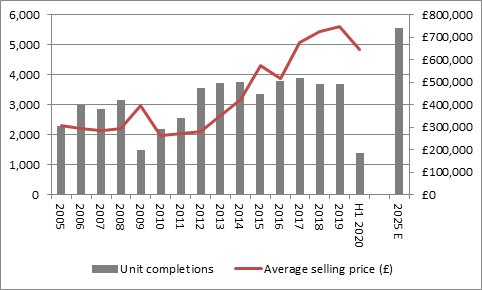

“This is a huge statement of confidence in the company’s prospects and also those of the segment of the UK housing market that Berkeley addresses, which is high-end properties in London and the South East of England. Berkeley’s average selling price in the six months to October 2019 (its fiscal first half) was £644,000.

“Berkeley may be committed to returning dollops of cash to its shareholders but it continues to invest in its operations, too. The firm is planning to increase housing production and delivery by some 50% over the next six years, a plan that is based on work that is already ongoing on 25 major regeneration sites.

Source: Company accounts, completions target for 2025E announced on 22 January 2020

“This implies the completion of around 5,500 dwellings by 2025 and politicians, economists and investors alike will be pleased to hear such a bullish outlook from company chairman Tony Pidgley and chief executive Rob Perrins.

“Mr. Pidgley’s record in calling the housing cycle since Berkeley first floated on the London Stock Exchange in 1985 is second to none. Berkeley sold land and houses in the late 1980s in the view that the housing market had overheated and was vindicated by the vicious downturn of 1990-92, when the company began to build up its land bank once more, to the benefit of its balance sheet and shareholders alike

“Given Mr. Pidgley’s proven nose for the market, it is interesting to see how Berkeley is moving beyond its traditional, core London market and out into the Home Counties. Eight of the eleven new developments launched in the year to April 2019 were based outside of the nation’s capital.

“And while some may question why Berkeley is able to lavish such large amounts of cash upon its investors, Help to Buy is not the reason why. In the year to April 2019, just 6% of Berkeley completions saw customers use the scheme, compared to an overall average of 37% across the quoted FTSE 100 and FTSE 250 house builders. In this case, money is now flowing from taxpayers’ pockets to shareholders, via the builder.

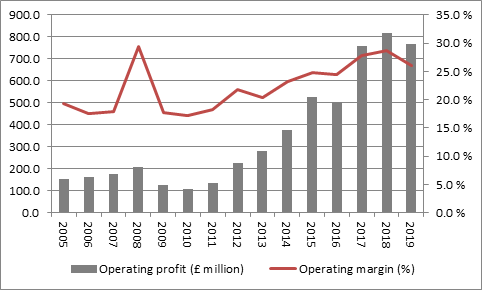

“Instead it is the firm’s land-buying skills, focus on high-end properties in the South East and operational acumen mean that its operating margins are high, at 26%, and those margins in turn support the cash flow that funds share buybacks and dividends. In addition, the company ended its fiscal first half in October with £1.1 billion of net cash on its asset-backed balance sheet.”

Source: Company accounts. Fiscal year to April.