“A stalling of house prices, an increase in costs and a drop in Help-to-Buy volumes are all chipping away at the foundations of Bellway’s share price, as the house builder warns of margin pressure, to perhaps suggest that this is as good as it gets for the housebuilders,” says Russ Mould, AJ Bell Investment Director. “That said, the builders still have strong forward sales books, cash-rich balance sheets and operate in a market where demand still seems to be outstripping supply (and the Government seems willing to intervene to offer support). As a result, those investors who are seeking income may not be too perturbed, as the house builders sector looks set to offer fat dividend yields in 2019 and 2020.

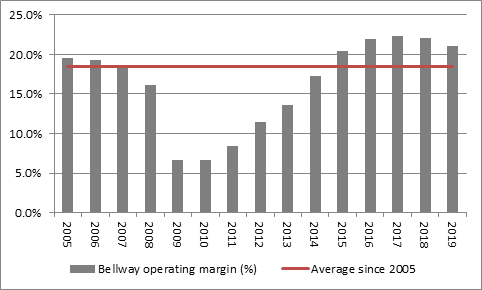

“Bellway’s comments about a return on operating margin to what management terms ‘a more normalised’ level appears to be the cause of today’s share price damage – although this then begs the issue of what a ‘normal’ margin really is.

“Since 2005, Bellway’s operating margin has averaged 18.4%, as the firm has made profits of £4.3 billion on sales of £23.6 billion over that 15-year period. The lowest return on sales was 6.7% in 2009 and 2010, as the industry emerged from the financial crisis, while the highest was 22.3% in 2017. Bellway’s operating margin thus peaked two years ago and management has now braced investors for a further drop in 2020.

Source: Company accounts. Financial year to July.

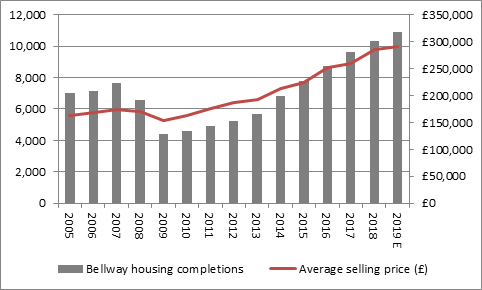

“Profits therefore look set to decline modestly in the year to July 2020, assuming no major deterioration in demand or pricing, although a forward order book of £1.3 billion represents 40% of the sales recorded in the year just ended, so Bellway has a fair degree of visibility here.

“However, prices only inched higher in 2019, rising 2.5% to £291,968 on average, and the issue is surely one of affordability rather than demand, even allowing for competition between lenders in the mortgage market and lowly interest rates.

Source: Company accounts. Financial year to July.

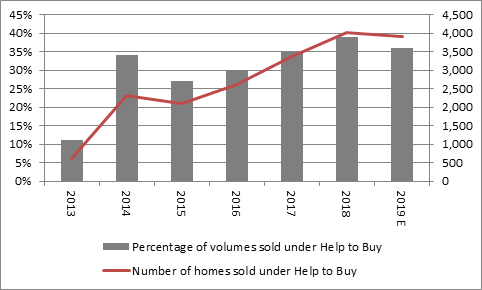

“It is therefore interesting to note that even Help to Buy volumes ebbed a little in the year just ended. The percentage of Bellway homes sold under the scheme fell from 39% to 36%, or by around 2% in numerical terms.

Source: Company accounts. Financial year to July.

“The likely drop in annual profits in 2020 means that Bellway’s shares will not immediately appeal to momentum hunters, although income-seekers may be a little less concerned.

“The FTSE 250 stock still offers a 4.8% dividend yield for 2020, based on consensus analysts’ forecasts, and that yield is covered 2.8 times by forecast earnings, compared to an average earnings cover across the sector of 1.6 times. Bellway also has a £201 million net cash pile (and the sector as a whole is sat on £2.9 billion in net cash).

“There are higher yields on offer from FTSE 100 and FTSE 250 peers but only Redrow offers better cover and only Redrow comes on a lower forward price/earnings ratio for 2020. Bellway is also the second cheapest builder on the basis of price to book value (on a historic basis).

|

|

2020E |

Historic |

||

|

|

PE (x) |

Dividend yield (%) |

Dividend cover (x) |

Price/NAV(x) |

|

Crest Nicholson |

8.4 x |

8.3% |

1.44 x |

1.19 x |

|

Bellway |

7.5 x |

4.8% |

2.79 x |

1.36 x |

|

Redrow |

6.7 x |

5.0% |

2.99 x |

1.48 x |

|

Barratt Developments |

9.2 x |

7.1% |

1.54 x |

1.49 x |

|

Bovis |

10.1 x |

8.8% |

1.14 x |

1.51 x |

|

Taylor Wimpey |

8.0 x |

11.2% |

1.12 x |

1.61 x |

|

Countryside Properties |

7.8 x |

4.8% |

2.66 x |

1.87 x |

|

Berkeley Homes |

13.2 x |

4.1% |

1.83 x |

1.91 x |

|

Persimmon |

8.7 x |

10.1% |

1.14 x |

2.62 x |

|

AVERAGE |

8.2 x |

6.6% |

1.57 x |

1.48 x |

Source: Sharecast, consensus analysts' forecasts, company accounts for historic NAV per share figures