Russ Mould, investment director at AJ Bell, comments:

“Barclays is down heavily in early trading, despite a decent set of third quarter figures. With conduct, restructuring and loan impairment costs falling to a combined £893 million from £1.57 billion a year ago, pre-tax profits for the three-month period jumped to £1.1 billion from £837 million.

“However, profits fell sharply at the Corporate and Investment Banking arm at Barclays International. While this should not have been a surprise, given the trend seen in results from global integrated banking peers such as JP Morgan Chase, Citigroup and Bank of America, it does highlight the cyclical and volatile nature of the unit’s earnings. The combination of potentially fickle markets, expensive staff and regulatory pressure mean that the investment banking arm is a low-multiple business in valuation terms and this is weighing upon the rating attributed to Barclays overall by the market.

“At 186p Barclays’ shares trade at a substantial discount to the bank’s tangible net asset (or book) value per share of 281p.

“Barclays therefore trades at a bigger discount to book value than Royal Bank of Scotland, which is the market’s (not so) polite way of saying it is either not sure of the value attributed to the assets on Barclays’ balance sheet, it doesn’t like the bank’s strategy or both.

|

| 2017 E |

|

|

| P/E | Price/book | Dividend yield | Dividend cover |

Barclays | 11.1 x | 0.68 x | 1.6% | 5.5 x |

HBSC | 14.3 x | 1.32 x | 5.4% | 1.3 x |

Lloyds | 9.1 x | 1.24 x | 5.9% | 1.9 x |

Royal Bank of Scotland | 10.7 x | 0.82 x | 0.2% | 49.4 x |

Standard Chartered | 18.6 x | 0.78 x | 1.3% | 4.0 x |

|

|

|

|

|

|

|

|

|

|

Barclays | 8.6 x | 0.68 x | 3.3% | 3.5 x |

HBSC | 13.3 x | 1.32 x | 5.4% | 1.4 x |

Lloyds | 9.4 x | 1.24 x | 6.6% | 1.6 x |

Royal Bank of Scotland | 9.9 x | 0.82 x | 3.5% | 2.9 x |

Standard Chartered | 13.0 x | 0.78 x | 3.3% | 2.3 x |

Source: Digital Look, analysts’ consensus forecasts

“The ongoing investigation in the USA into the alleged mis-selling of mortgage backed securities does not help here, as this could lead to a substantial fine, while Barclays still has reputational issues with which to deal, in light of the bungled whistle-blowing investigation and the 2019 court case which will see former senior Barclays executives in the dock to answer allegations of fraud relating to the 2008 Qatar-backed fund raising.

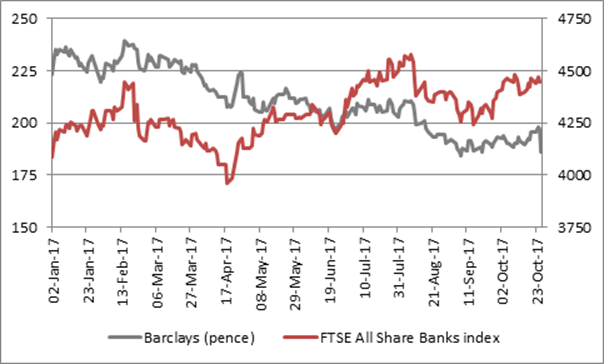

“But for whatever the reason, Barclays’ share price is not behaving like that of its peers to suggest that something isn’t right somewhere within the bank.”

Source: Thomson Reuters Datastream