“Shareholders in Barclays must be terribly frustrated. The bank has just come through the final payment protection insurance compensation payments in 2019, the conclusions of the Qatar fraud trial case in 2020 and seen off a fierce challenge to its strategy from an activist investor in 2021 only for chief executive Jes Staley to now step down so he can defend his reputation and contest how the FCA and PRA have chosen to characterise his relationship with Jeffrey Epstein in their investigation,” says AJ Bell Investment Director Russ Mould. “The bank’s board must be disappointed, too, but Mr Staley had already dropped hints that he might step aside sooner rather than later and Barclays clearly had a succession plan in place, given how seamlessly C.S. Venkatakrishnan has taken the reins as chief executive, pending regulatory approval.

“This smooth transition seems to be limiting the damage to Barclays’ share price as does Mr Venkatakrishnan’s CV. Like Mr Staley, he has an investment banking background from his time at both JP Morgan Chase and Barclays, so this suggests there will be no major shift in strategy at the bank now.

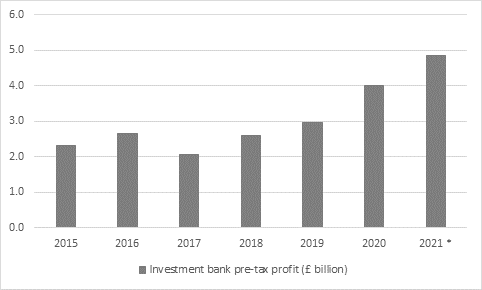

“Mr Staley had fended off Edward Bramson’s call for the investment bank to be spun-off and the unit’s performance in the first nine months of 2021 have gone a long way to justifying that stance. It generated £4.8 billion in pre-tax income between January and September, compared to £3.2 billion in the prior period a year ago, generating a 16.4% return on equity and two-thirds of the bank’s total pre-tax profit for 2021 to date in the process.

Source: Company accounts. *First nine months of 2021

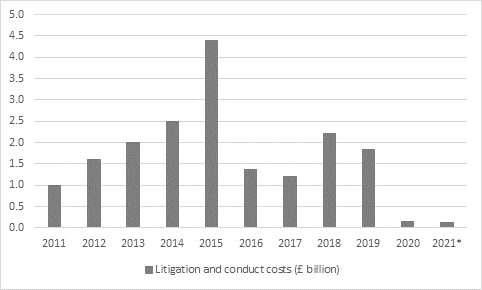

“Mr Venkatakrishnan’s time as Barclays’ Chief Risk Officer from 2016 to 2020 may also reassure shareholders that he is a safe pair of hands, after a decade where the bank has, ultimately, forked out £18.4 billion in litigation and compensation payments. The sums involved here have decreased sharply since the final round of payments relating to the payment protection insurance (PPI) scandal and if Mr Venkatakrishnan can use his CRO experience to keep them low then investors will surely be delighted.

Source: Company accounts. *First nine months of 2021

“Mr Staley may have done much to hone Barclays’ strategy and its cost base but one thing he did not do was get the share price going. They fell by 9% during his near-six-year spell as CEO, while the FTSE 100 rose by 14% in the same time frame. Shareholders will be looking to Mr Venkatakrishnan to improve upon that record.

|

|

|

Percentage change in |

|

|

CEO |

Tenure |

Barclays shares |

FTSE 100 |

|

Matthew Barrett |

Oct 1999 - Aug 2004 |

15.4% |

(26.0%) |

|

John Varley |

Sept 2004 - Dec 2010 |

(47.8%) |

32.3% |

|

Bob Diamond |

Jan 2011 - Jul 2012 |

(35.8%) |

(4.5%) |

|

Antony Jenkins |

Aug 2012 - Nov 2015 |

43.8% |

12.8% |

|

Jes Staley |

Dec 2015 - Nov 2021 |

(9.3%) |

13.9% |

Source: Refinitiv data

“He might get some help if the economy picks up speed, the pandemic can be finally beaten off and monetary policy shows anything like signs of normalisation, should interest rates start to rise and yield curves steepen. The ongoing pressure upon Barclays’ net interest margin owing to the zero interest rate policies (ZIRP) and Quantitative Easing (QE) was beyond Mr Staley’s control and his successor will be hoping for a bit of a tailwind here, especially as Mr Venkatakrishnan must still face other long-term challenges which are weighing on the bank and its share price.

“Global indebtedness continues to rise, raising the risk that even modest increases in interest rate trigger a global slowdown, while Barclays must also fend off threats to its position from challenger banks and upstart fintech rivals.

“These issues help to explain why Barclays’ shares still trade below their net asset, or book value, per share and if Mr Venkatakrishnan can get sustainably elevate return on equity to a point whereby the trade at a premium (as shares in many of Barclays’ US peers do) then investors may well think he is worth every penny of his £2.7 million annual pay in cash and shares, with £135,000 annual pension payments on top.”

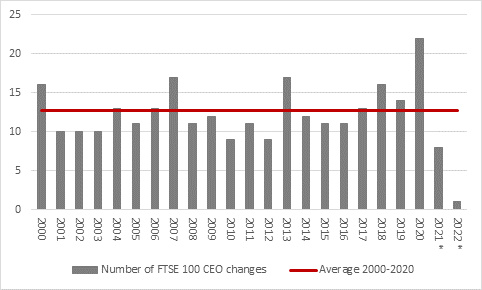

APPENDIX: FTSE 100 CEO departures in 2021

“Before his departure, Jes Staley was the thirty-ninth longest serving CEO in the FTSE 100, at five years and eleven months, just ahead of the index average of five years and seven months.

“He is the ninth FTSE 100 CEO to step down in 2021. One of those nine, Marco Gobbetti, will hand over to his successor in 2022.

|

|

|

2021 |

|

|

|

|

Company |

In |

Out |

Date |

|

1 |

Rio Tinto |

Jakob Stausholm |

Jean-Sebastian Jacques |

01-Jan-21 |

|

2 |

Entain |

Jette Nygaard-Andersen |

Shay Segev |

21-Jan-21 |

|

3 |

Lloyds |

William Chalmers (interim) |

Antonio Horta-Osorio |

01-May-21 |

|

4 |

AVEVA |

Peter Herweck |

Craig Hayman |

01-May-21 |

|

5 |

Smiths Group |

Paul Keel |

Andy Reynolds-Smith |

25-May-21 |

|

6 |

Glencore |

Gary Nagle |

Ivan Glasenberg |

01-Jul-21 |

|

7 |

Lloyds |

Charlie Nunn |

William Chalmers (interim) |

16-Aug-21 |

|

8 |

Barclays |

C.S. Venkatakrishnan |

Jes Staley |

01-Nov-21 |

|

|

|

2022 |

|

|

|

9 |

Burberry |

Jonathan Akeroyd |

Marco Gobbetti |

1-Apr-22 |

Source: Company accounts

“After 22 changes at the top in 2021, this represents a welcome period of calm. Nine changes is the lowest figure since 2012 and is well below the post-2000 average of 13 changes in CEO a year.

Source: Company accounts. *As announced so far.