Over £14billion withdrawn from pensions since freedoms launched in April 2015 (latest HMRC statistics)

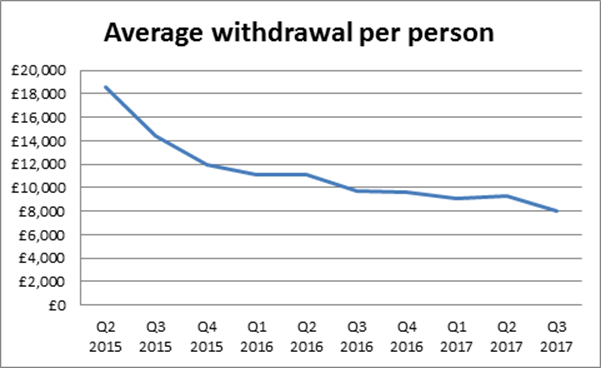

Average withdrawal per person hits new low (£8,030) in Q3 2017, suggesting people aren’t on the whole splurging irresponsibly

Government must address engagement gap to ensure savers make the most of the freedoms

Tom Selby, senior analyst at AJ Bell, comments:

“The popularity of the pension freedoms shows no signs of abating, with 40,000 more people choosing to access their retirement pot flexibly in the third quarter of 2017 versus the same period in 2016. However, it’s interesting to note the average value of withdrawals per person continues to fall, hitting a record low of £8,030 in Q3 2017 (see chart below). The fact people are on average taking less out per quarter doesn’t point to mass irresponsible spending, although we need a wider picture of people’s incomes and personal situations to draw firm conclusions.

“£14 billion has been withdrawn from pensions since the freedoms launched in April 2015 and these latest figures set the scene for the forthcoming Work & Pensions Committee inquiry into the reforms. It is the manner of these withdrawals that is key, however, and specifically the sustainability of people’s retirement spending.

“We are concerned that an engagement gap could be emerging among savers who use the freedoms. For many the only aim is to get their hands on their tax-free cash as quickly as possible, with little thought being given to things like investment strategy. The fact large numbers of people who withdraw their entire pension simply shove it in a bank account is evidence of this. Improving engagement and understanding of retirement saving needs to become a central aim for the Government.”

Source: HMRC statistics