HMRC has today published the latest quarterly pension freedoms statistics. You can read full release here: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/773230/Pensions_Flexibility_Jan_2019.pdf

Highlights

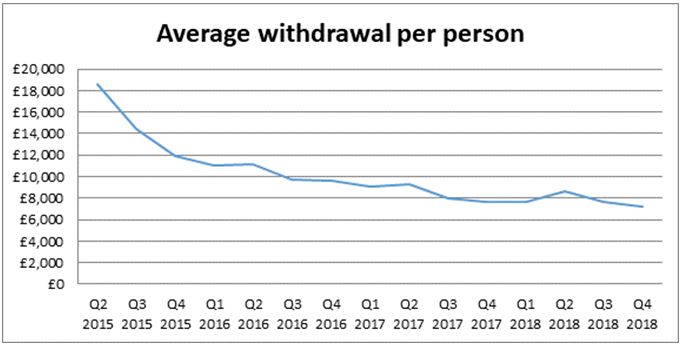

• Average pension freedoms withdrawals per person dropped to a record low of £7,197 in Q4 2018, down from £7,597 in the previous quarter

• In total 264,000 people withdrew £1.9billion from their pensions during the final quarter of 2018

• Figures may be evidence of drawdown savers reining in spending in response to difficult investment conditions

• £23.6 billion has now been flexibly withdrawn from retirement pots since the reforms launched in April 2015

Tom Selby, senior analyst at AJ Bell, comments:

“While the popularity of the pension freedoms shows no signs of abating, the amount people are withdrawing from their funds per quarter has dipped to the lowest level on record.

“Although it is too early to draw firm conclusions about why this has happened, it could be a sign of people showing restraint in how they spend their hard-earned retirement pots.

“Millions of savers in drawdown have faced torrid markets during 2018, with the FTSE 100 down 12% and most funds delivering negative investment returns. In these circumstances it can be sensible to cut back withdrawals in order to ensure you don’t run out of money during retirement.

“The past 12 months will have been particularly difficult for anyone who entered drawdown for the first time – especially if they took large income withdrawals just as markets hit the skids.

“Anyone in this situation has an uphill task to recover the losses they have made, and will be praying for a better year for their investments in 2019.”

Source: HMRC statistics