The Office for National Statistics (ONS) has today published its annual survey of occupational pension schemes in the UK.

You can read the full report here: https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/pensionssavingsandinvestments/bulletins/occupationalpensionschemessurvey/2018

Key points:

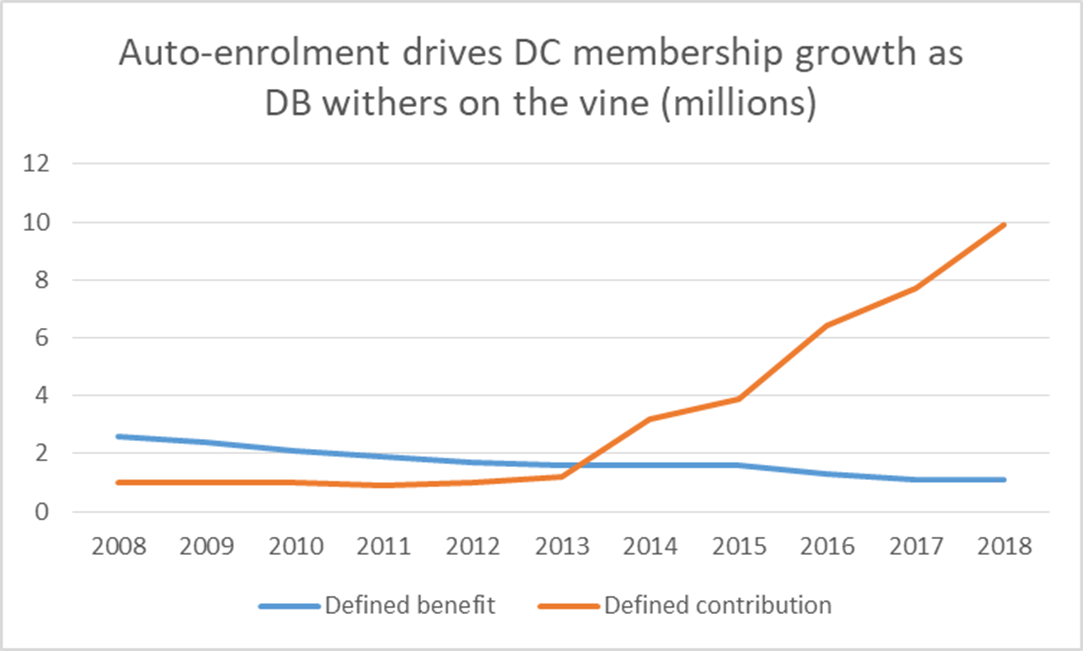

• Auto-enrolment drove pension scheme membership in the UK to 45.6 million in 2018, a new record

• Active membership of private sector defined contribution (DC) schemes up almost 30% to 9.9 million

• Average DC contributions rose from 3.4% to 5% in 2018, suggesting most employers are paying in close to the legal minimum

• Private sector defined benefit (DB) membership holds steady after a decade decline

Tom Selby, senior analyst at AJ Bell, comments:

“The first stages of the auto-enrolment revolution have been a success, with pension scheme membership now at record levels and inertia proving a powerful force as opt-outs remain low.

“The job is not done, however. While getting more people to pay into a pension is clearly a big step forward, the amount people contribute needs to increase substantially if we are to avoid a retirement crisis in the coming decades.

“Plans are already afoot to scrap the earnings band at some point in the mid-2020s, meaning that minimum contributions will be calculated from the first pound someone earns.

“However, even this would likely leave the average earner short of achieving their retirement dreams.

“A 25-year-old earning £30,000 and saving at the minimum would end up with a pot of around £200,000 in today’s prices by age 65 – that would buy a guaranteed, inflation protected income worth about £6,500 at the moment*. If you combine that with the state pension you’ll be living on around £15,000 a year.

“Savers who have retirement aspirations beyond this level shouldn’t wait for Government to sort their pensions out for them. There is no guarantee any future Prime Minister will extend minimum contribution rates much beyond the current level given the impact this could have on the wider economy in the short-term.

“It is therefore incumbent on individuals to take responsibility and where possible save over and above the minimum levels set out under auto-enrolment.”

*Assumes person earns £30,000 a year for life and investments grow at 3% a year above the current rate of inflation of 2%. Annuity rate courtesy of the Money Advice Service annuity calculator.

Source: ONS