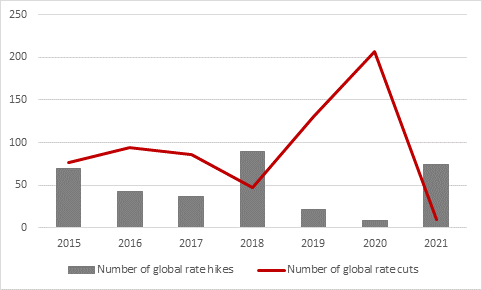

“The Reserve Bank of Australia’s decision to scrap one of its three key tools and start tightening monetary policy provides an extra edge – as if one were needed – for this week’s meetings of the US Federal Reserve and the Bank of England,” says AJ Bell Investment Director Russ Mould. “Persistent inflation, a rash of rate rises around the globe and moves to taper or even halt Quantitative Easing in New Zealand, Canada and others all beg the question of whether the American and British monetary authorities are in danger letting policy run too loose for too long – although some would argue the damage is already done on that front.

Source: www.cbrates.com

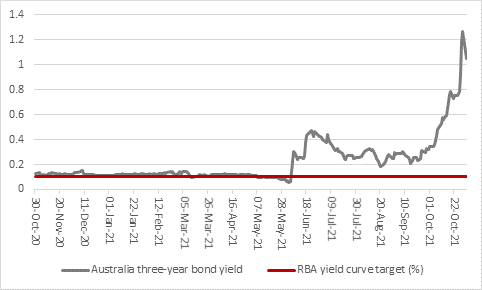

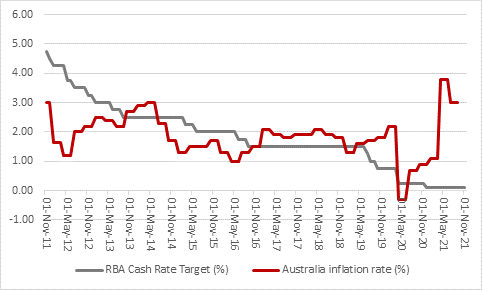

“In some ways the Aussies had no choice other than to scrap their policy of yield-curve control, whereby Governor Philip Lowe and the Reserve Bank of Australia (RBA) sought to hold the yield on Canberra’s three-year Government bond at 0.1%. Faced with a headline inflation rate of 3%, holders of Australian Government debt had already begun to rebel.

“The yield on the three-year paper hadn’t traded below 0.1% since May and it blew past 1% at the end of last month in what may have been the first stirrings by bond vigilantes, at least in developed markets. If inflation really does take hold, then bonds yielding less than the prevailing rate simply represent return-free risk and ultimately, they lock in guaranteed losses in real, post-inflation terms.

Source: Refinitiv data

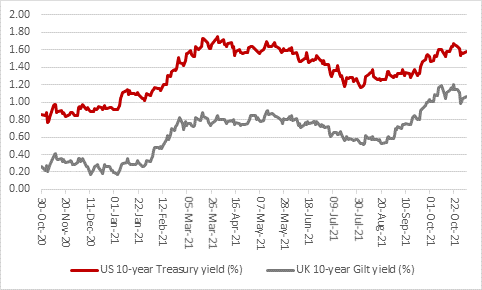

“Neither the Fed nor the Bank of England has quite been presented with so blatant a degree of investor insolence, but bond holders are asking questions all the same. Over the past 12 months the yield on the benchmark US 10-year Treasury has increased from 0.86% to 1.57% and the yield on the UK 10-year Gilt has gone from 0.26% to 1.06%.

“Both figures are still well below the prevailing rates of inflation in the US and the UK, and both countries 2% inflation target, so bond markets are still giving policy makers the benefit of the doubt – although you could argue that Quantitative Easing programmes and massive Fed and Bank of England bond holdings give them little choice as central banks seek to bend bond markets to their will.

Source: Refinitiv data

“The Aussies are still keeping interest rates at 0.1% and running Quantitative Easing at A$4 billion a week so the policy shift can be seen as relatively minor, but it still reflects a shift in momentum toward tightening and away from loosening, or at least the status quo of ultra-loose monetary policy.

Source: Refinitiv data

“Even if the Bank of England raises the prospect of interest rate rises (or even puts through its first increase since summer 2007) financial investors may still wonder whether they are running policy too loose.

“After all, the Office for Budget Responsibility expects UK GDP to grow by more than 6% in each of 2021 and 2022 and currently forecasts inflation to run at 4% in 2022, well above the Bank of England’s target. Unemployment is below 5%, wage growth is picking up, house prices are rising sharply and asset prices generally are surging, as evidenced by London’s FTSE indices and global benchmarks.

“Under such circumstances you would normally expect central bankers to be applying the brakes, especially as the combination of huge fiscal and monetary stimulus is designed to boost demand and may therefore have just as much bearing on the current surge in inflation as supply-side dislocations.

“It is just possible the pandemic has tempted central banks to over-stimulate the economy, in the view that unemployment would be the greater evil than inflation, a perspective which ultimately got everyone, including investors into terrible trouble, in the 1970s and prompted a shift in the 1980s, 1990s and 2000s that inflation was the greater peril. Perhaps the question now is when will the pendulum swing again, prompting the Bank of England, US Federal Reserve and others to start tapering QE and raising interest rates with vigour. The answer, for now, seems to be ‘not yet,’ but perhaps tighter policy in Canada, New Zealand, Australia and others is the first sign of a subtle change in thinking.”