Berkshire Hathaway Q3s. Monday 5 November 2018

Asset allocation suggests Buffett is more wary of bonds than he is of equities

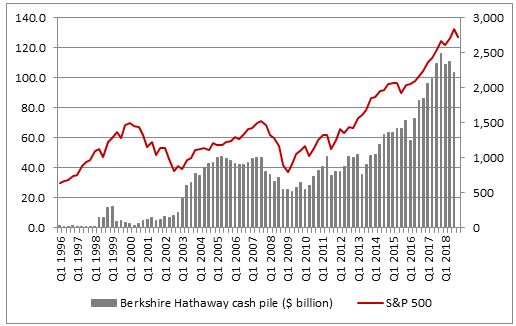

“The decision by Warren Buffett to spend some of his Berkshire Hathaway investment vehicle’s enormous cash pile on a share buyback is grabbing the headlines, as it suggests the legendary investor is struggling to find a company that he wants to acquire at a price he wants to pay,” says Russ Mould, AJ Bell Investment Director.

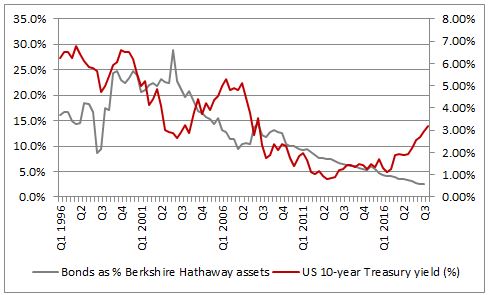

“But a deeper look at how Berkshire’s balance sheet breaks down by asset mix, rather than in just absolute dollars, suggests that the Sage of Omaha is a lot more concerned about fixed income than stock markets. At $18.7 billion, US Government bonds represent just 2.5% of Berkshire’s assets, continuing a downward trend that has been in evidence since 2003.”

Source: Company accounts

“Perhaps Buffett feels US Government bonds represent poor value, given what remain relatively low yields on a historic basis and how inflation (and especially wage inflation) are starting to pick up. US wages grew 3.1% in October, a figure which suggests a summer drop in the headline overall inflation rate to 2.3% may not last long, a trend which could mean that even a 3.2% yield on the US 10-year Treasury, for example, may not offer as much wealth protection as you would like.

Source: Company accounts, Refinitiv data

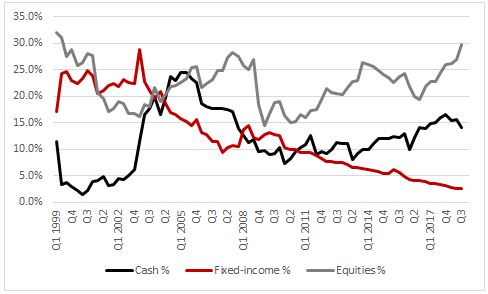

“While cash, including short-term Treasury bills, does stand at a near-record high $103.6 billion, this represents 14.1% of Berkshire’s assets, down from 16% at the end of 2017 and way below the 24.5% of 2005, when Buffett had clearly begun to develop doubts about the bull market that began in 2003, ran out of puff in 2007 and cratered in 2008-09.

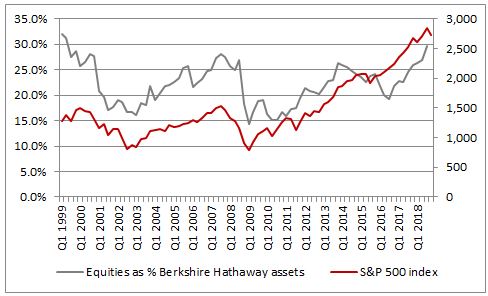

“It is also noticeable how equities, including a $17.5 billion stake in Kraft-Heinz, now represent 29.7% of Berkshire’s assets, not too far from the highest mark of the last two decades, which was 32% in early 1999.

“That surge reflects investment performance but it does take equities up toward the levels seen at the last two US stock market peaks, so it will be interesting to see how Buffett and business partner Charlie Munger husband their cash from here, given their patient, long-term approach.

“With his focus on companies with pricing power and the lowly fixed-income allocation perhaps Buffett is preparing for inflation and stronger-than-expected economic growth, even if the surge in the absolute cash pile over the last few years would imply he is finding it hard to buy companies that fit his exacting criteria at a reasonable price.”

Source: Company accounts, Refinitiv data