“This just goes to show how sentiment drives share prices in the near term but also how fundamentals, such as profit and particularly cash flow, ultimately drive valuation and total shareholder returns over the long term.”

In the short-term

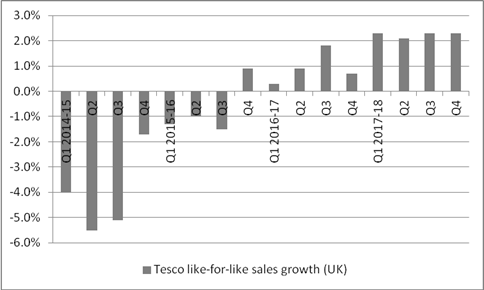

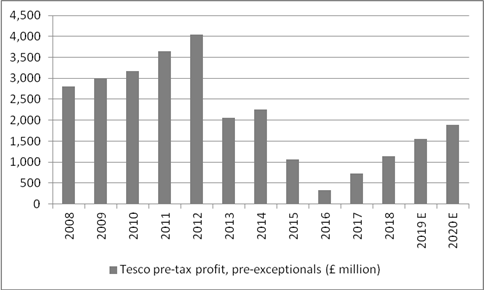

After the accounting scandals, the rise of competition from the discounters and drops in profit in 2016 and 2017, expectations at Tesco are much lower than they are at ASOS. This is why a 2.8% increase in total sales and a meagre 0.4% increase in like-for-like sales at the group level were still seen as a good result for the grocer, especially as the UK operations grew on a like-for-like basis for the ninth straight quarter. In addition, Tesco’s profits grew for the second straight year to suggest the firm is returning to form.

Source: Company accounts

Source: Company accounts, Digital Look, consensus analysts’ forecasts. Financial year to January.

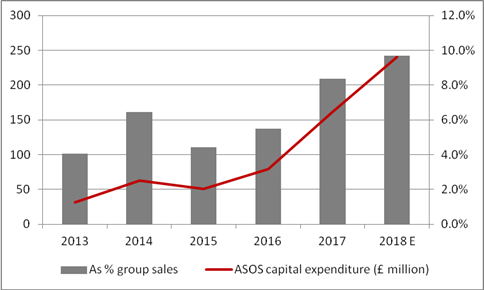

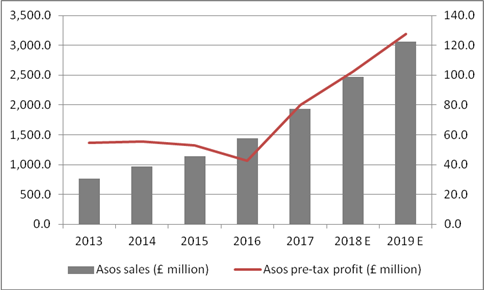

A 29% surge in sales at ASOS is still a terrific outcome but the share price has responded to an increase in the capital investment budget for the year, to between £230 million and £250 million, up from £200 million to £220 million. This means less cash flow and additional costs in the near term, even if ASOS is responding to and generating rapid growth in its core business, and shows how investors, a little more nervous after the recent slide in the broader markets, are perhaps demanding more jam today and less jam tomorrow. Tesco also returned to the dividend list this year while ASOS does not pay a dividend preferring to reinvest its cash for future growth.

In the long term

ASOS’ increased capital requirements implies that the narrative of “online good” and “bricks and mortar bad” is not quite as simple as it may seem. The holy grail for any investor is to find a truly scaleable business, one that can grow but does not require additional investment to do so. Online retailers are seen by some as fitting the bill – as they do not have physical stores and all of the expense that they can bring – but as Boohoo.com and ASOS are now showing, they still need warehouses and they need to keep stock (inventory) on hand, to ensure rapid customer fulfilment. This investment can soak up cash, reduce scope for any possible future dividends and add costs to the business, so online retail, while a powerful model, still requires careful management. ASOS has had profit blips before, relating to IT and additional investment.

Source: Company accounts, Digital Look, consensus analysts' forecasts. Financial year to August.

ASOS has a market capitalisation of £5.5 billion and is expected by analysts to make £102 million in pre-tax profit in the 12 months to August.

Tesco has a market cap of £21.8 billion and has just made £1.1 billion pre-tax, with analysts expecting £1.5 billion in the 12 months to January.

This means ASOS trades on a forward price/earnings (PE) ratio of 67 times, Tesco on around 16 times – the FTSE 100 trades on around 14 to 15 times. Earnings growth is expected at both but with its lower rating and higher dividend yield the lowly expectations at Tesco mean that its shares may offer a greater margin of safety, relative to ASOS, should something go wrong. By contrast, the lofty rating at ASOS, which already factors in lofty growth expectations, means the share price will be a lot less tolerant of any disappointment, no matter how minor.

None of this is to say Tesco will be the better investment in the long term than ASOS, or vice-versa – Tesco now has to prove that it can maintain its new-found momentum and do so while digesting its acquisition of Booker for a start.

But it does go to highlight the importance of valuation when assessing a company’s strategy and competitive position in the long term and its performance relative to profit and cash flow and dividend expectations in the near term.