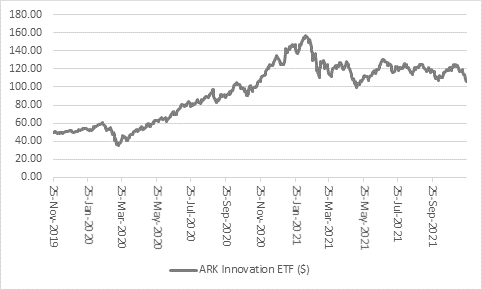

“Cathie Wood’s actively-managed ARK Innovations Exchange Traded Fund (ETF) offers investors quick and relatively cost-effective exposure to the theme of ‘disruptive innovation’ and to a basket of potentially high-octane growth stocks, but performance is starting to flag,” says AJ Bell Investment Director AJ Bell. “A pull-back Tesla may not be helping right now but the electric vehicle play is still up by some 90% over the past year, so that hardly explains why the ARK Innovations ETF, or ARKK, peaked in February and is now languishing 33% below its February all-time high – technically a bear-market style decline.”

Source: Refinitiv data

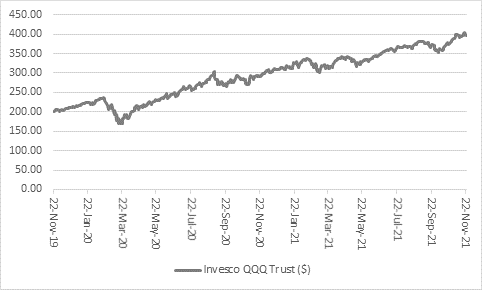

“This seems all the more surprising in the context of how the Invesco QQQ Trust which is trading at around the $400 mark for the first time in its history. This fund seeks to track and deliver the performance of the NASDAQ 100 index, which comprises the largest 100 non-financial firms in the NASDAQ Composite equity benchmark.

Source: Refinitiv data

“Both products follow tech and growth stocks, although there are clear differences in their key holdings and this may well explain the disparity in performance. The QQQ follows profitable, cash-generative, already-dominant companies such as Microsoft, Apple, Alphabet, Meta Platforms (or Facebook as was) and NVIDIA, while Cathie Wood’s vehicle is more focused on up-and-coming, would-be champions such as virtual healthcare company Teladoc, cryptocurrency exchange Coinbase, video game developer Unity Software and Zoom Video Communications. The only real overlap is Tesla.

|

Invesco QQQ Trust |

|

|

ARK Innovations ETF |

|

|

|

Weighting |

|

|

Weighting |

|

Microsoft |

10.9% |

|

Tesla |

11.2% |

|

Apple |

10.8% |

|

Teladoc |

6.9% |

|

Amazon |

7.5% |

|

Coinbase Global |

5.9% |

|

Tesla |

6.0% |

|

Unity Software |

5.3% |

|

NVIDIA |

4.2% |

|

Roku |

5.1% |

|

Alphabet C |

4.1% |

|

Zoom Video Comms. |

4.4% |

|

Alphabet A |

3.9% |

|

Spotify |

4.2% |

|

Meta Platforms |

3.4% |

|

Square |

3.8% |

|

Adobe |

2.1% |

|

Shopify |

3.5% |

|

Netflix |

2.0% |

|

Zillow |

3.3% |

Source: Refinitiv data, Invesco, ARK Invest

|

Invesco QQQ Trust |

|

|

ARK Innovations ETF |

|

|

|

Weighting |

|

|

Weighting |

|

Technology |

63.2% |

|

Technology |

34.3% |

|

Consumer discretionary |

20.7% |

|

Healthcare |

29.9% |

|

Healthcare |

6.1% |

|

Consumer discretionary |

18.7% |

|

Consumer staples |

3.3% |

|

Unclassified - equity |

7.2% |

|

Industrials |

3.0% |

|

Financials |

4.7% |

|

Telecoms |

1.8% |

|

Industrials |

3.9% |

|

Financials |

1.1% |

|

Telecoms |

1.3% |

|

Utilities |

0.9% |

|

Unclassified - non-equity |

0.2% |

Source: Refinitiv data, Invesco, ARK Invest

“The difference may therefore lie in the stocks involved, especially as ARK Innovations ETF is actively-managed and a few of its selected stocks are trading way, way below their highs after some terrible pastings. Zillow, Teladoc and one-time pandemic darling Zoom have all halved in the past year and Roku has lost 50% of its value since July.

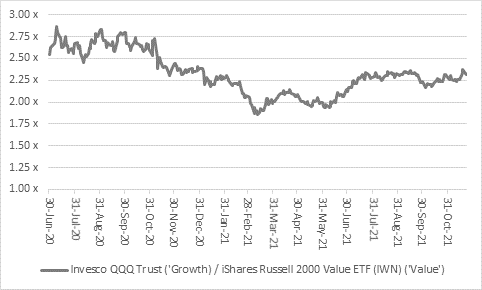

“Whether this means Cathie Wood is just having a bad run or whether investors are starting to steer clear of the riskier end of the growth and tech stock spectrum is hard to divine, although the Invesco Trust is also finding it harder to keep up with cyclical, or value, stocks.

“This can be seen in the relative performance of the QQQ compared to the iShares Russell 2000 Value ETF over the past couple of years. The ‘value’ tracker has risen by 76% in value, compared to the QQQ’s 60% gain.

Source: Refinitiv data

“This trend began last summer and may have reflected markets’ efforts to price in a post-pandemic economic upturn, as well as the rise of inflation and the prospect of rising interest rates and bond yields.

“In the event of a rip-roaring economic recovery, investors may feel less need to pay a premium for growth stocks since earnings growth will be easier to find among cyclical stocks which have done less well and come at cheaper valuations. Jam today will be cheaper and easier to find, and potentially less risky, than jam tomorrow, especially if inflation boosts nominal sales and profit figures.

“Equally, rising inflation may finally oblige central banks to raise interest rates, or at least persuade bond vigilantes to rebel and demand higher coupons if they are to lend to governments.

“This can also impact investors’ appetite for growth stocks, whose profits and cashflows are very much back-end loaded and may only mature in many years’ time as disruptors become the next-generation of winners (assuming they make it). One way to value this type of firm is to use a discounted cashflow model (DCF) and the higher the discount – or interest – rate used to discount back the value of forecast future cashflows to their net present value (NPV), then the lower the value of the equity.

“Bond yields have risen from their lows on both sides of the pond and this could be crimping interest in long-duration assets such as early-stage tech stocks, even if the effects have been by no means immediate.

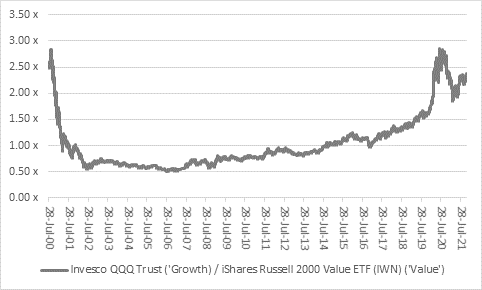

Source: Refinitiv data

“We have seen a similar switch from growth and jam tomorrow to cyclicals and jam today before. It happened after as the tech, media and telecoms bubble lost air and finally burst. The move was stunningly violent as market leadership changed and the collapse of the new market darlings dragged headline indices lower for the thick end of two years during the 2001-03 bear market. And once investors regained their balance, the new upturn was spearheaded by a new range of sectors rather than the TMT trio which had driven the prior bull market.

Source: Refinitiv data

“It’s far too early to say that ARK Innovations ETF is sunk for good. The QQQ is regaining some momentum in relative terms to the iShares Russell 2000 Value ETF and that may reflect nerves over the latest COVID-19 statistics, lockdowns in Europe and what they might mean for the economic upturn – if it falters, growth stocks could again come back into the spotlight and earnings growth will again be difficult to find.

“In that scenario, where the economy rolls over, central banks are unlikely to raise rates and bond vigilantes will be less worried about inflation, too. That could also boost the valuation of tech stocks, as lower discount rates boost the value of future forecast cash flows.

“But if inflation does catch fire, central banks find themselves behind the game and bond vigilantes sell their paper and demand higher coupons, ARK Innovations ETF (and perhaps the QQQ) could find the going choppier from here.”