“There is an old saying that ‘markets ride the escalator up and take the elevator down’ and the FTSE 100 may be about to put that to the test, especially if Monday’s sharp losses are not quickly erased,” says AJ Bell Investment Director Russ Mould. “Falls in cryptocurrencies, meme stocks, richly-valued momentum favourites and the marked underperformance of emerging markets have all been hinting at a decrease in risk appetite and now the core, headline indices are starting to wobble. Investors must now decide whether this is a chance to buy on the dips or the first sign that there is trouble ahead.

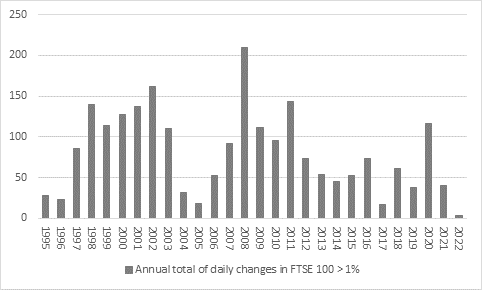

“Stumbles in previously red-hot areas are a concern and a hint that at the very least that more volatility may be around the corner. After an understandably wild 2020, which began with the pandemic’s spread and closed with the jubilation prompted by ‘Pfizer Monday’, 2021 was very quiet, with just 40 daily moves of more than 1% in the FTSE 100 from open to close, compared to 116 the year before.

Source: Refinitiv data

“Vaccinations, an end to lockdowns (albeit to varying degrees from country to country), an economic upturn and ongoing monetary and fiscal support from central banks and governments all provided markets with succour and helped restore some calm.

“But impoverished governments are now turning off the fiscal taps and looking for ways to raise money and try to restore their tattered finances, while central banks are inching away from ultra-loose monetary policy and even thinking of tightening it.

“In 2021, there were 113 individual interest rate rises from central banks against just 13 decreases, according to www.cbrates.com, and the score is already 11-1 in favour of hikes relative to cuts in 2022. The Bank of England put through a tentative increase in December and is expected to follow through again in February while markets now think the US Federal Reserve could take interest rates to 1.25% from 0.25% this year and even start to reduce Quantitative Easing.

“This may be markets’ biggest concern, even allowing for the prospect of geopolitical tensions between Russia and NATO and the US over Ukraine. A tidal wave of cheap liquidity has buoyed markets and, whenever there has been trouble, provided them with a comfort blanket. Less loose, or even tighter, monetary policy, may take that blanket away.

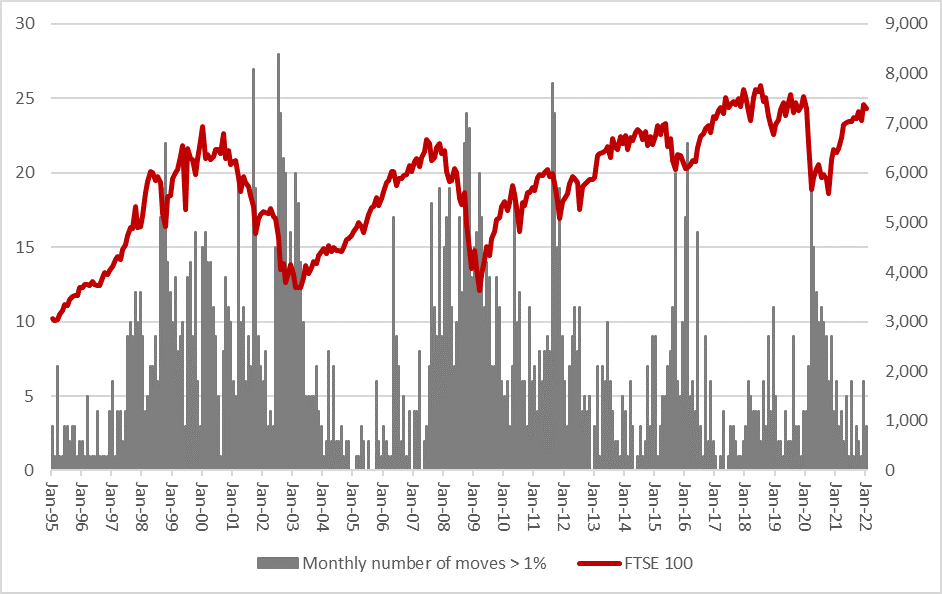

“It may be no coincidence that the more liquidity central banks have provided, via zero interest rate policies (ZIRP) and Quantitative Easing (QE), the more somnolent equity markets have become, at least if the FTSE 100 is any guide.

“Since 1995 there have been, on average, 83 daily moves of more than 1% in the UK’s headline index, but that average figure drops to 80 over the past twenty years, 57 over the last ten and 54 over the last five – and that is despite the pandemic-inspired panic of 2020.

|

FTSE 100 daily moves, from open to close |

|

|

|

|

|

|

Average |

|||

|

|

post-1995 |

20 years |

10 years |

5 years |

|

Number of moves > 1% |

66 |

63 |

44 |

41 |

|

Number of moves 2-5% |

17 |

16 |

13 |

13 |

|

Number of moves > 5% |

1 |

1 |

0 |

1 |

|

|

83 |

80 |

57 |

54 |

|

|

|

|

|

|

|

|

post-1995 |

2020 |

2021 |

2022 |

|

Number of moves > 1% |

66 |

72 |

33 |

2 |

|

Number of moves 2-5% |

17 |

41 |

7 |

1 |

|

Number of moves > 5% |

1 |

3 |

0 |

0 |

|

|

83 |

116 |

40 |

3 |

Source: Refinitiv data

“The withdrawal of cheap liquidity will therefore be a key test for markets especially as there do seem to be four clear ‘cycles’ when it comes to market volatility, as evidenced by how the FTSE performs relative to how quietly or noisily the index proceeds, on a daily basis.

Source: Refinitiv data

• A period (often lengthy) of total calm, where headline indices do not gyrate, as they made steady, consistent upward progress

• A period where the first doubts about the bull market creep in, sellers begin to challenge buyers with their force of their opinions and headline benchmarks make progress but at a lesser rate and with greater effort. Ultimately, this proves too much for nervy buyers and holders, who crack and start to sell, perhaps taking profits where they can or cutting a few losers that are beginning to frustrate them.

• A period where doubts finally give way to panic. Volatility becomes the norm as share prices and indices gyrate wildly, but with a clear downward bias. Finally, the wet towels come slopping into the ring as buyers capitulate and turn seller at almost any price.

• Markets bottom amid this final frenzy. Calm descends as buyers begin to regather their nerve as they find assets that are once more attractively valued, and markets begin their next march higher.

“For the moment it seems that we are in either late stage one or early stage two. There is no guarantee that stages three and four will follow – they didn’t in 2020, for example, even after the short, sharp bear market of February and March that year.

“But central banks began to pour on the monetary medicine back then, whereas they might now be taking away the happy pills. The question is for how long, because we are barely two months into the Fed’s Quantitative Tightening scheme and still two months away from the US central bank’s first planned rate rise and – from the narrow view of financial markets – it’s already not sitting well.”