• Fed tapers but S&P 500 hits a new record high

• Tighter monetary conditions aren’t shaking the bull market off course

• Historical analysis of US and UK stock market performance in rate hiking cycles

Laith Khalaf, Head of Investment Analysis at AJ Bell, comments:

“The S&P 500 has firmly shaken off the US Fed’s plan to taper its bond buying programme, by hitting a new record high. The US central is very gradually taking its foot off the accelerator pedal, and on current plans will stop injecting money into the economy in the middle of next year. The Fed has left itself some wriggle room by saying it will adjust the ongoing reduction as it sees fit.

“Tapering is not tightening, but it is a precursor, and can carry significant market implications. This was amply demonstrated by the taper tantrum of 2013, prompted by the Fed daring to announce plans to cut back on the stimulus it was injecting. This time around, markets are much more sanguine, as demonstrated by the US stock market hitting a fresh record high. It just goes to show that even tighter monetary conditions aren’t necessarily going to shake this bull market off course.

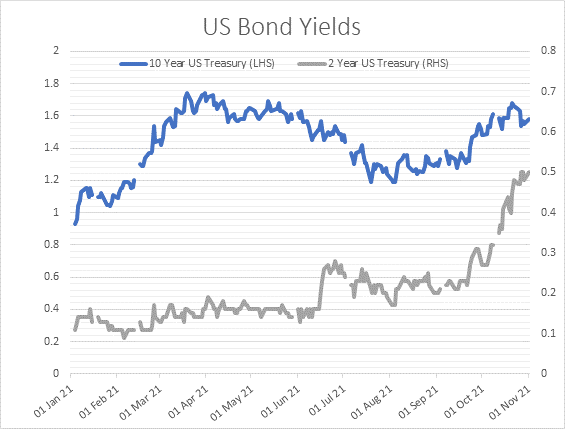

“The US bond market has been remarkably calm, and the yield on the benchmark 10 year US Treasury bond is today actually lower than it was in March of this year. The shorter end of the yield curve is not quite as tranquil. The yield on the 2 year Treasury note has shot up to a post pandemic high of around 0.5%, significantly higher than the 0.15% it sat at for the first half of this year. Of course, these are still historically low rates. But the flattening of the yield curve suggests markets think inflation, and tighter policy, is a bit of a flash in the pan, and will dissipate over a longer time frame. The UK gilt market paints a similar picture, in that shorter dated bonds have sold off more than the longer end of the market in the past few months.

“With the benchmark 10 year US bond yielding 1.6% and the UK counterpart yielding 1%, both less than the target rate of inflation, bond market pricing is not suggesting that inflation is a sustained problem in the long term. Of course, the QE taps are still flowing on both sides of the Atlantic, so it’s fair to question whether such a highly manipulated market is a reliable reflection of anything other than the shopping activities of the central banks.”

Source: Refinitiv

TINA (There is No Alternative)

“One of the key questions around the monetary tightening cycle, in both the UK and the US is what effect it will have on equity markets. Higher interest rates make life tougher for companies, and there is a school of thought that current stock market valuations are built on all the central bank liquidity injected since the financial crisis, and will come crashing down like a house of cards once monetary policy is tightened.

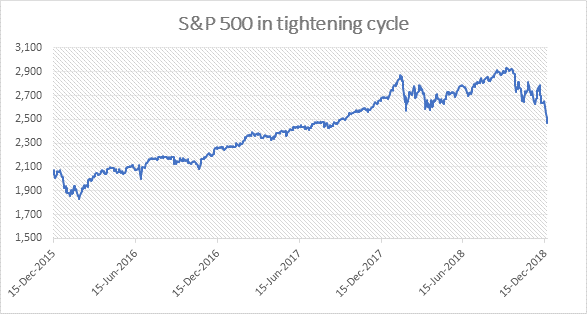

“Also characterised as TINA (There Is No Alternative), the premise is that money has been herded into equities because bond yields have been driven so low, offering investors no other alternative. There is considerable merit in this assessment, however the most recent US tightening cycle of 2015 to 2018 challenges the view that tighter monetary policy will necessarily lead to an equity market sell-off. Between December 2015 and December 2018, US interest rates rose from 0.15% to 2.4%. During that time, the S&P 500 rose by 21%, providing investors with a 26% total return including reinvested dividends (see chart below).

Sources: Refinitiv, FE

“Back here in the UK, in the last mini tightening cycle, interest rates were increased from 0.25% to 0.75% between November 2017 and August 2018. Over this admittedly small time frame, the FTSE All Share rose by 1%, and provided investors a 4% total return, with dividends included (source: FE). There was still an extraneous factor at play here in the form of the tortuous post-referendum execution of Brexit, which had significantly dampened appetite for UK stocks over this period. Even so, the data from this side of the pond also suggests a tightening cycle would not necessarily be negative for the stock market.

“In the US, the tightening cycle of 2015 to 2018 did incorporate a period of robust economic growth and extensive Trump tax cuts, though that only goes to show that monetary policy isn’t the only game in town when it comes to stock market performance. Indeed, we should expect economic growth in a tightening cycle, unless central banks have got their forecasts badly wrong, or they are forced to act against their will to stave off inflation.

“If you subscribe to the view that current stock valuations are predicated on low fixed interest yields, you should also note that bonds are not a happy place to be in a tightening cycle, and actually still don’t offer an attractive alternative to stocks until interest rate hikes start to level off, and stop being a threat to capital values. You could characterise this as TISNA - There Is Still No Alternative. Against an unfriendly backdrop for the main competitor for stocks, it’s perhaps no surprise that equity markets have still been able to make progress despite tighter monetary conditions.”

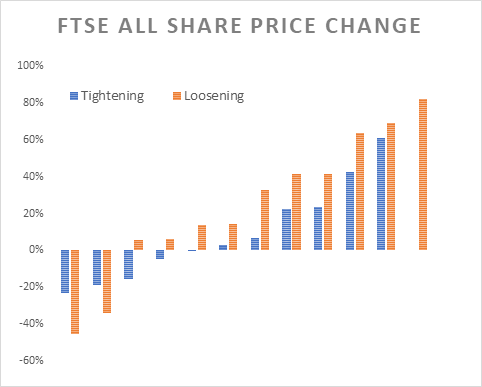

The historical perspective

Looking back through history, we can also see the relationship between market performance and monetary policy is not so simple as lefty loosey, righty tighty. The chart below shows the price performance of the FTSE All Share in tightening and loosening cycles going back to 1965. On balance, the chart shows loosening cycles are probably marginally better for the stock market, but it’s a close run thing, and actually there’s clearly no direct correlation between the direction of monetary policy and the performance of the stock market.

Source: Refinitiv

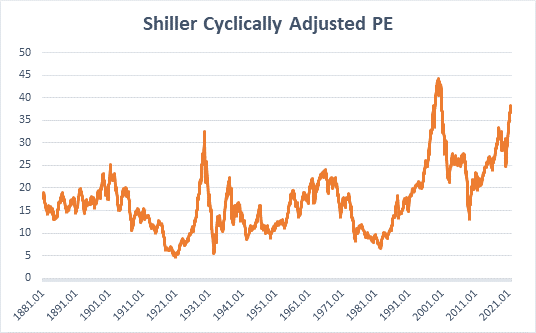

So while the tapering and tightening of monetary policy on both sides of the Atlantic certainly represents the beginning of a big shift in the financial landscape, it doesn’t necessarily mean the stock market can’t make progress from here. That’s particularly the case in light of the fact that the pace of tightening is likely to be glacial, and there’s plenty of fiscal stimulus still flowing into the US and UK economies. Given that monetary policy is going to be only slightly less accommodative for the foreseeable future, it seems likely that markets will be driven by other considerations, particularly seeing as they already seem to have digested the direction of travel. That’s not to say there aren’t risks to equity markets, in particular the elevated valuation on US stocks, which on one widely used measure has only been higher in the dot com boom (see chart below). As yet though, a gently rising interest rate environment shows no tentative signs of shaking this bull market off course.