“The good news came in three parts.

Earnings per share (EPS) of $2.73 for the second quarter beat the consensus estimate of $2.69, as sales rose 14% and EPS rose 30%

Sales growth from iPhones accelerated to 14%, the fastest advance since the July-September quarter of 2015, and high–margin revenues from services (apps) and products such as the Apple Watch jumped by nearly a third, to represent a fifth of the group total.

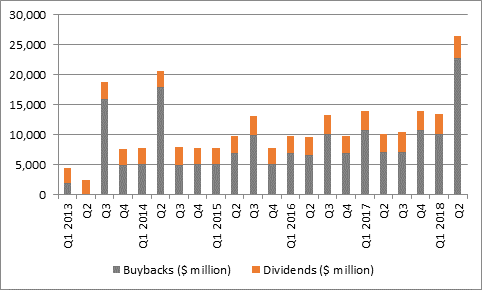

Apple increased its quarterly dividend to $0.63 from $0.57 and launched a $100 billion buyback. Since its fiscal first quarter for 2013 (calendar Q4 2012) the company has already returned $246 billion in cash to shareholders, compared to a market capitalisation of around $850 billion, with more to come.

Source: Apple accounts. Based on company’s fiscal year

“As such, it seems almost churlish to pick holes in the numbers, especially as fellow tech stocks Tesla and Snap are both heavily in loss and burning cash like it is going out of fashion.

“However, the Apple numbers still leave three questions unanswered and boss Tim Cook and team may need to address them if the stock is to avoid repeating what happened at Netflix, when the share price popped on the release of its headline subscriber and sales and profit numbers but then gave back all of those gains and more once analysts took a closer look at cash flow and the balance sheet.

Group gross and operating margins fell year-on-year, by 0.6 percentage points to 38.3% and 0.7 percentage points to 26% respectively.

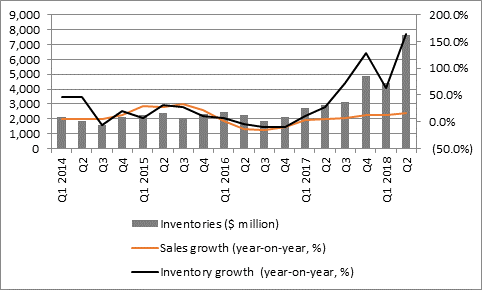

Margins fell even though the company aggressively built product and piled up inventory. Group sales grew 14% year-on-year but inventory surged 163% to $7.7 billion. This will not ease concerns over iPhone demand and adds to an apparent pile-up of finished components in the supply chain in Asia, as evidenced by how inventories at contract silicon chip maker TSMC have also ballooned. At the very least, components suppliers to Apple could be in for another tough quarter or two as those stockpiles are worked down.

Source: Apple accounts. Based on company’s fiscal year

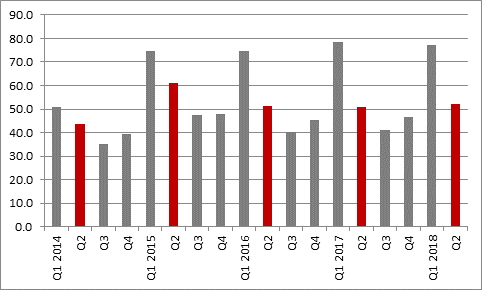

iPhone volumes reached 52.2 million in the quarter, up from 50.8 million a year ago – but Apple sold 61.2 million in the January-March period three years ago in 2015. This will only fuel fears over slowing upgrade and customer replacement cycles owing to the high price tag associated with the iPhone X in particular.

Source: Apple accounts. Based on company’s fiscal year. Shows iPhone volumes in million, with fiscal Q2 figures highlighted

“None of this is to suggest it is all about to go pear-shaped for Apple shareholders, given the massive cash returns, but those bumper dividends and buybacks may mean the investment case in shifting from growth to income.

“In addition, investors’ reaction to the Apple numbers could have a read-through for the wider US equity market.

“After all, US stocks surged in late 2017 and early 2018 in anticipation of faster corporate profits growth, higher dividends and increased buybacks in the wake of President Trump’s cuts to corporation tax.

“The earnings season for calendar Q1 2018 has delivered all of this, with earnings per share up by around 20% year-on-year, according to data from Standard & Poor’s, and there has even been a wave of major merger and acquisition deals thrown in for good measure.

“And yet US stocks, using the S&P 500 index as a benchmark, are still down by nearly 1% in 2018 and trade some 7% below their January all-time high. This might be troubling for bulls, given it looks as if the market is struggling to progress when everything is going so smoothly, perhaps to suggest that concerns over lofty valuations are starting to give some cause for concern.”