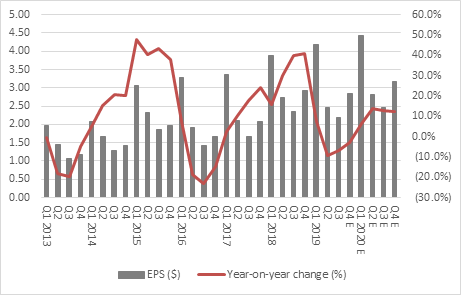

“Apple’s shares are up some 70% from their January lows and stand only a fraction below fresh all-time highs, so the company needs to deliver some good news with its fourth-quarter results and also guidance for the first quarter,” says Russ Mould, AJ Bell Investment Director. “Revenues from the iPhone have fallen year-on-year for the last three quarters in a row and earnings per share have dropped in the last two reporting periods. Analysts and investors will therefore be looking to chief executive Tim Cook for confirmation that Apple will start growing its profits again in Q1.

“The good news for shareholders is that earnings estimates have crept marginally higher since Apple reported its Q3 numbers back in July.

|

|

2019 |

2020 |

||||||

|

|

Q1 |

Q2 |

Q3 |

Q4E |

Q1E |

Q2E |

Q3E |

Q4E |

|

Actual EPS ($) |

4.18 |

2.47 |

2.18 |

|

|

|

|

|

|

EPS forecast ($), July |

|

|

|

2.83 |

4.44 |

2.81 |

2.46 |

3.18 |

|

EPS forecast ($), now |

|

|

|

2.84 |

4.53 |

2.85 |

2.44 |

3.22 |

Source: Company accounts, consensus analysts’ forecasts from Zack’s and NASDAQ. Company financial year to September.

“The net result is that consensus forecasts assume Apple will begin to grow its earnings again in the current quarter which began on 1 October, so it may be that guidance for Q1 is more important than the Q4 results.

“And if profits do start to grow again in the new quarter, that would end the Cupertino giant’s third down-cycle in profits this decade and help the firm to erase January’s profit warning from investor’s memories.

Source: Company accounts, consensus analysts’ forecasts from Zack’s and NASDAQ. Company financial year to September.

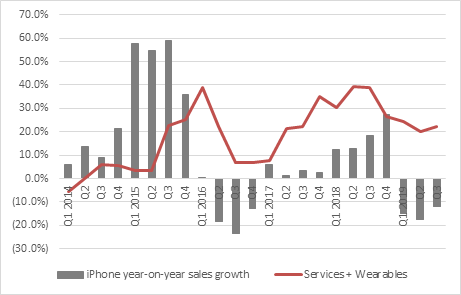

“The 2013 and 2016 profit slumps were related to iPhone product cycles and the latest one may be no different, given slower-than-expected take-up of iPhone X after some meaty price hikes, a slowdown in China and concerns over lengthening product cycles as cost increases make Apple buyers ponder whether the incremental functionality is worth it or not.

“There is clearly an expectation that iPhone 11 will drive an upgrade cycle at loyal users and this does raise the stakes – especially as Apple sub-supplier Knowles Corporation dished out a profit warning last week, when it cited weakness in component sales for high-end smartphones.

“Analysts and investors will therefore be looking toward the trend in revenues from the iPhone for reassurance. This will largely depend on volumes, mix and also pricing, since Apple has been cutting prices on older products and launched iPhone 11 at a slightly lower price point relative to iPhone 10.

“Revenues from iPhones fell 12% to $26 billion in the third quarter and fans of the stock will be looking for improved momentum here.

“Services and wearables will also be another feature to watch, as this unit continues to flourish.

“Their combined sales rose by 22% in Q3 to $17 billion, some 32% of the group total (up from 19% three years ago). There seems little reason to expect app sales to stumble, barring perhaps a nasty recession, and they also make Apple customers sticky and more likely to upgrade their devices in the future, creating a bit of a virtuous circle.

Source: Company accounts

“Apps and services sales are high margin. In Q3 the gross margin here was 64.1% compared to 30.4% on hardware products so further strong sales increases here should help to support margins, profits and ultimately cash flow. And it is cash flow which funds Apple’s bounteous dividend and share buyback programmes, which have been a source of support to the share price.

“Since Apple began to pay dividends and buy back stock in its fiscal Q1 2013 quarter (the final three months of calendar 2012), the firm has returned $354 billion in cash directly to shareholders - $271 billion via buybacks and $82 billion via dividends.

“Apple’s market cap on 1 October 2012 was $618 billion, so holders or buyers on that date have already got 57% of their investment back in pure cash, with a capital gain of nearly 80% on top.

“This goes a long way to explaining why the firm has such a loyal fan club, especially as it still had $102 billion in net cash on its balance sheet at the end of its fiscal third quarter in June. It will take a lot to persuade shareholders that Apple cannot maintain its pre-eminence, although Tim Cook won’t want to preside over too many more profit warnings like the one dished out in January, which capped a 37%, three-month slide in the share price.”

APPENDIX: Apple’s guidance for Q4 earnings

|

$ million |

Q1 |

Q2 |

Q3 |

Q4 E* |

|

|

|

|

|

|

|

Sales |

84,310 |

58,015 |

53,809 |

61,000-64,000 |

|

Gross profit |

32,031 |

21,821 |

20,227 |

23,750 |

|

Gross margin |

38.0% |

37.6% |

37.6% |

37.5%-38.5% |

|

|

|

|

|

|

|

Operating expenses |

(8,685) |

(8,406) |

(8,683) |

(8,700-8,800) |

|

|

|

|

|

|

|

Operating profit |

23,346 |

13,415 |

11,544 |

14,975 |

|

Operating margin |

27.7% |

23.1% |

21.5% |

24.0% |

|

|

|

|

|

|

|

Other income |

560 |

378 |

367 |

200 |

|

Tax |

16.5% |

16.2% |

15.7% |

16.5% |

|

|

|

|

|

|

|

Net profit |

19,965 |

11,561 |

10,044 |

12,671 |

|

EPS ($) |

4.18 |

2.47 |

2.18 |

2.84 |

Source: Company accounts, company earnings guidance alongside Q3 2019 results in July. *Based on mid-point of company guidance