Investment platform AJ Bell believes the Government should create a Student Loan Climate Offset programme. The programme would allow students to offset some of their student loans if they invest in the Government’s existing Green Gilts, which would be used to help the Government meet its COP26 commitments.

The scheme would:

• Lessen the impact of the Augar proposals on students and give them the option to repay their loans earlier

• Lower the amount of student loan debt which the government will ultimately write-off

• Engage graduates with investment concepts at an earlier age

• Reduce burden on the state in later life due to better investment engagement

• Provide the nation with a pool of patient capital to fund the Green economy of the future

The student loans company has 8.5 million customers with outstanding balances of £160bn – if all of them invested £10,000 that would be £85 billion for the Government to invest in projects to help meet the country’s climate change targets.

Background to the proposal

The Augar Review into Post-18 education in the UK has proposed a number of changes to the student loans system and it is likely we will get the Government’s response to the recommendations alongside this month’s Budget. Whilst Augar proposed a reduction in the headline University fee from £9,250 to £7,500, the proposals come with a nasty sting in the tail. Lowering the threshold at which graduates are expected to begin making repayments from their gross income and - far more pernicious – an increase in the loan term from 30 to 40 years before any outstanding balances are written off.

These proposals will hurt middle earners and notably women most significantly since they never get to make a dent in the capital value of the loan. The proposal to extend the repayment period will see them bearing an additional 9% tax for 5-10 years longer. For a typical outstanding balance of £45,000 of debt upon graduation, this could add over £10,000 in repayments.

For new undergraduates, the prospect of lower headline fees may be enough to assuage their concerns, but for existing graduates the proposals do nothing. What’s worse, the prospect of having their loan terms changed retrospectively ought to be an issue they campaign as hard against as some do against the Government’s climate policies.

How the Student Loan Climate Offset would work

• People with student loans can offset their outstanding student debt balance against an investment in the Government’s existing Green Gilts

• The investment is made via an ISA to ensure no tax implications for the student and encourage wider investment engagement

• The offset would reduce their interest payments and the time it takes to repay the loan

Impact of the proposal

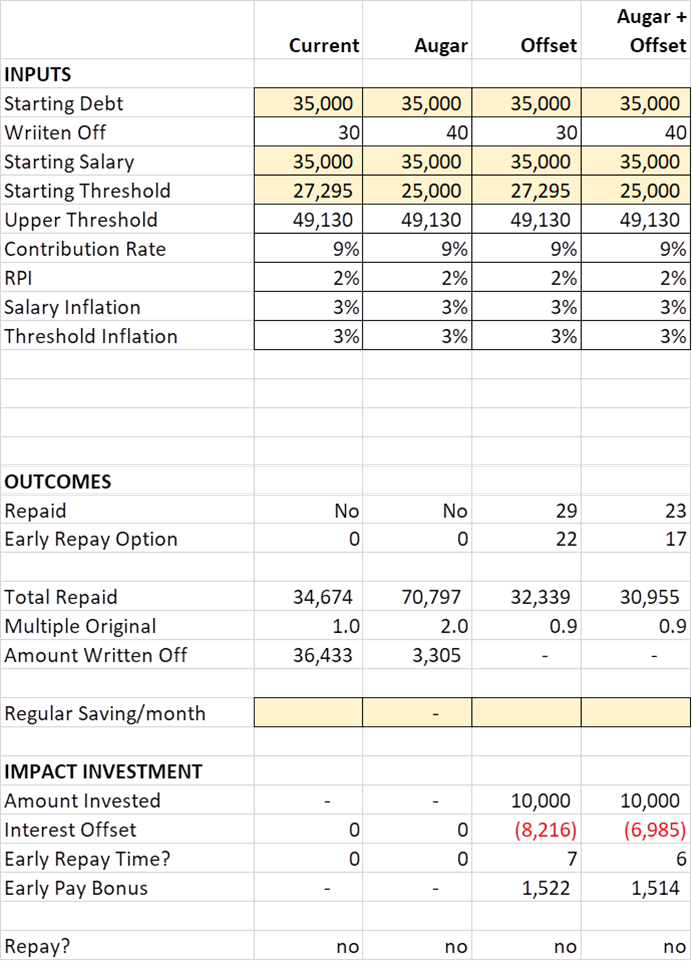

Someone with a student loan of £35,000 under the Augar proposals would repay a total of £70,797 over 40 years, over double the £34,674 they would repay under the current scheme.

Offsetting £10,000 of that loan would enable them to reduce the amount they repay to £30,955 and reduce the term that they are saddled with debt to 23 years, with an early repay option after 17 years.

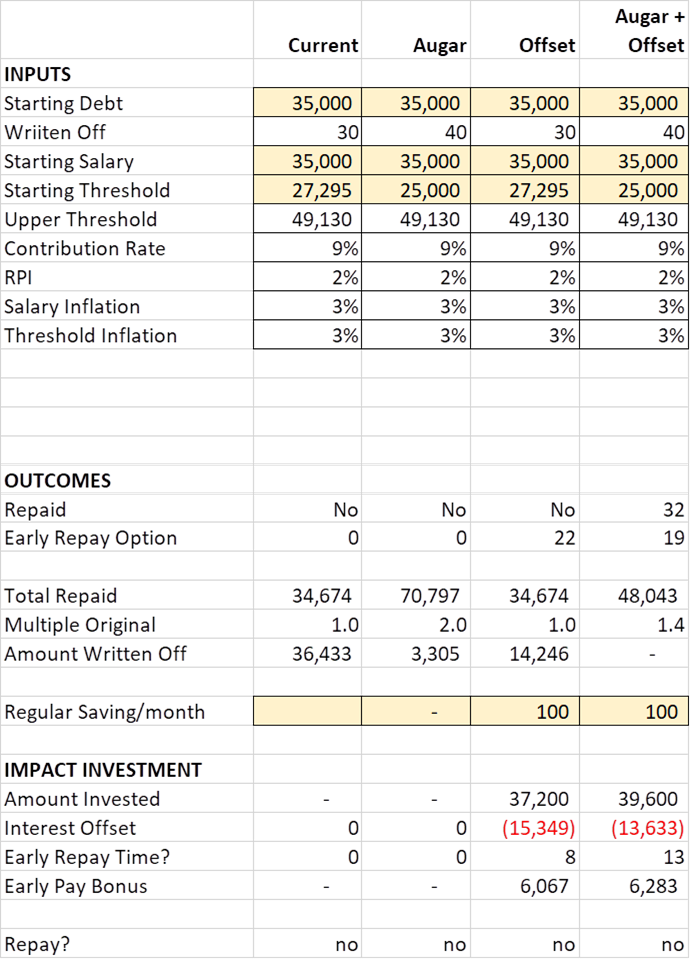

Alternatively, and perhaps more realistically, investing £100 a month and offsetting that against their student loan would enable them to reduce the amount they repay to £48,043 and reduce their term to 32 years, with an early repay option after 19 years. They would also accumulate a larger investment fund of £39,600

Full calculations provided in the tables below.

Kevin Doran, chief investment officer at AJ Bell, comments:

“The Augar proposals have the potential to land another financial body blow, not just on the next generation of young professionals but on middle Britain, just at a time when they are struggling with the rising cost of living. Retrospective action could see them paying the 9% student tax for 10 years longer than they agreed when opting to attend university and recent graduates would also start paying the tax earlier in their working lives.

“To help these people, who by now must feel powerless to effect change on this issue, we propose a recommendation to sit alongside those put forward by the Augar review. A change that provides a means and incentive for students to repay their loans earlier. A change designed to engage students with their savings at an earlier age and a change that allows them to fund the future changes the world needs to reach net zero.”

Impact of the Student Loan Climate Offset:

£10,000 lump sum offset

£100 a month regular investment offset

Why Student Loans and the Green New Deal are intrinsically linked

On 31st October, the UK Government will host the COP26 summit in Glasgow. Bringing world leaders together on a path towards ‘net-zero’ carbon emissions by middle of the century, the summit will be used by the Government to help bring substance to the Green Industrial Revolution announced by the Prime Minister back in November 2020.

Backed by £12bn of State-funding, designed to ‘crowd in’ private funds, the ‘Green New Deal’ is expected to create 250,000 new high-skilled jobs in industries ranging from offshore wind, small scale nuclear and nascent hydrogen power.

To create this workforce of tomorrow, or ‘task force net zero’ requires investment in education today. Whilst the Government’s lifetime skills guarantee is a welcome step towards upgrading the nation’s skill-base, the high-value research, development and knowledge needed to unlock this potential will unquestionable be generated within the UK’s universities.

As a nation, we ought to be proud of our higher education institutions. Attracting students from across the world, our seats of advanced learning have a rich history of global influence and have acted as an agent for social mobility.

Indeed, this quest for greater social mobility has been a key driver of successive governments’ higher education policies, resulting in student numbers doubling since 1995, with even great rises seen in female and BAME cohorts. Today almost 600,000 students are accepted onto UK university courses every year.

Such participation comes at a cost. A cost to both student and taxpayers thanks to the poorly named and even more poorly understood Student Loan. Hosting features of a financial loan, the student loan system used in the UK would be more accurately described as a deferred tax on successful students. For everyone else, the tab is instead passed back to the taxpayer.

Most student loans will never be paid off. Only 1 in 4 loans are expected to be cleared in full, with the remaining three quarters either being only partly repaid or having no contribution made whatsoever by the graduating student, before being written off as a bad debt 30 years hence.

As student populations have grown, the cost to students and society has expanded to unsustainable levels. In the most recent year for which we have data, 1.3m students took out £17bn of loans – adding an average of £15,000 each to the £160bn balance of student loans outstanding today.

And so, whilst the next generation and the world focusses its attention on the balance of carbon circulating by 2050, we believe the circulation of student debt in play by the middle of the century should be receiving similar levels of headlines, as £17bn/year of annual loans are projected to become £50bn/year and total unpaid debts balloon from £160bn to an estimated £1.2 trillion by 2050[1].

Q&As

How much will this cost the Government?

We believe the proposal is broadly neutral on the Government’s finances. The ability to control a spiralling of interest on student loans ought to reduce the amount of loans subsequently written off, which is the biggest cost to the nation from the existing system.

Our proposal has the potential to allow the highest earning students to repay their loans earlier than currently envisaged, which reduces the profits the Treasury make on such loans. Thought this is a direct cost to the nation’s finances, this ought to be recouped through the lower interest rates payable on Green Gilts due to the expected increase in demand.

Why should students be able to pay off less than they’ve borrowed?

To avoid that students could have to ‘settle up’ the total repayment to the value of the original loan in order to rid themselves of the 9% student tax

Doesn’t this just benefit rich people who could abuse the system?

If that is a concern a salary cap could be introduced at the upper threshold for calculating the interest rate since these are the loans which almost certainly repay in full.

What are the likely outcomes from the Government’s review into Student Debt?

A series of recent research papers issued from the House of Commons support unit provide an insight into Government thinking ahead of the Chancellor’s budget. The papers note that ‘Given the state of the public finances due to the pandemic, it’s likely that any changes to student finance proposed by the Government will have to result in major savings’ – indicating that the proposals will include a lowering of repayment thresholds, an extension in the period of repayment and even the prospect of increasing the 9% graduate tax to 10%.