“But these near-term issues should not detract from the positives, in the form of a forecast increase in advertising revenues in 2018, the well-covered dividend yield and the broadcaster’s strategic position, in the wake of the three-way battle for Sky.”

“Investors seem to be reacting with disappointment to ITV’s decision not to pay a special dividend, even though it increased its ordinary total payment for 2017 by 8% to 7.8p – a figure which equates to a 4.8% dividend yield on a share price of 162p. With the prospect of a further increase to come, helped by a forecast pick-up in advertising revenues after two years of declines, ITV still offers a premium yield relative to the wider FTSE 100.

“In addition, new boss Dame Carolyn McCall’s choice not to pay a special looks sensible for two reasons.

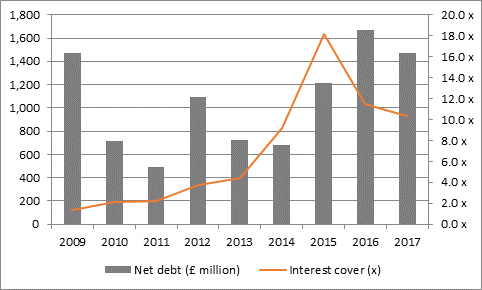

“The first is debt. After the additional distributions of 2011 to 2016, plus hefty acquisition spend on Talpa Media, UTV’s television operations, Leftfield, DiGa Vision, Big Talk, The Garden and others, mean ITV’s net debt position in no different to where it was in 2009, once leases, the pension deficit and contingent payments are included. Even though interest cover is way better, and ITV thus financially far stronger, Dame Carolyn will be aware of the dangers of adding too much debt (financial gearing) to a company whose profits can rise and fall very sharply according to only minor changes in advertising sales (operational gearing).

Source: ITV accounts

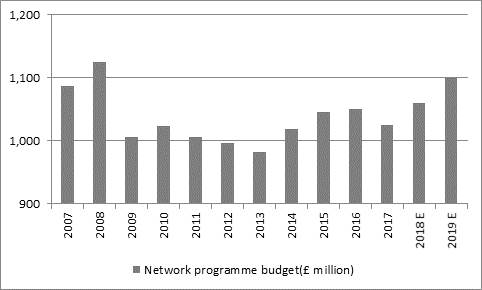

“The second reason her prudence is justified is the plan to invest in programming.

“ITV plans to increase its network programming budget from £1,025 million in 2017 to £1,100 million by 2019, a move which makes sense in the long term.

Source: ITV accounts

“Under Adam Crozier, ITV worked to build up its library of home-produced content to reduce its dependence upon advertising and the development of Victoria, Poldark, The Voice, Endeavour and other programmes has broadened the broadcaster’s revenue base. It therefore makes sense for Dame Carolyn to continue this strategy, especially as it is Sky’s control of such prime content as movies, sport and its own programming that has created a large and loyal customer base, which has in turn drawn bids from Twenty-First Century Fox, Disney and Comcast.

“This is not to say the Liberty Global’s 10% stake in ITV guarantees that a bid will arrive but the battle for Sky may help to focus minds on ITV’s long-term position – despite competition from Amazon, Netflix and rising consumption of media online and Liberty’s regular denials that it has any plans to make a formal approach.”