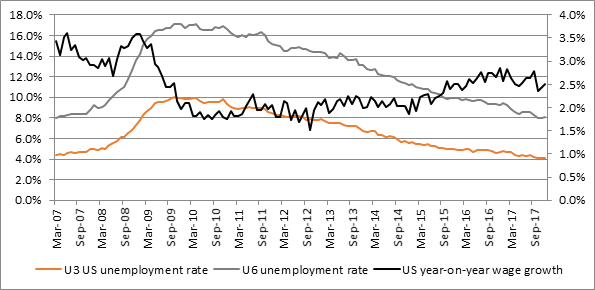

Source: US Bureau of Labor Statistics

“The CME Fedwatch website puts less than a 1% chance on a Fed hike in January but a 73% chance on an increase to 1.75% on 21 March and a 32% chance of three increases to 2.25% by the Federal Open Markets Committee meeting scheduled for 19 December.

|

| % chance at FOMC meetings in 2018 | |||||||

Number of hikes in 2018 | Fed Funds Rate | 31-Jan | 21-Mar | 02-May | 13-Jun | 01-Aug | 26-Sep | 08-Nov | 19-Dec |

0 | 1.25% to 1.50% | 99.5% | 26.6% | 24.9% | 7.5% | 6.7% | 3.5% | 3.4% | 2.6% |

1 | 1.50% to 1.75% | 0.5% | 73.0% | 70.2% | 38.5% | 35.4% | 21.6% | 20.9% | 16.0% |

2 | 1.75% to 2.00% |

| 0.4% | 49.0% | 50.6% | 49.4% | 42.7% | 41.8% | 34.7% |

3 | 2.00% to 2.25% |

|

|

| 3.4% | 8.1% | 27.9% | 28.5% | 31.9% |

4 | 2.25% to 2.50% |

|

|

|

| 0.4% | 4.1% | 5.1% | 12.7% |

5 | 2.50% to 2.75% |

|

|

|

|

| 0.2% | 0.3% | 2.0% |

6 | 2.75% to 3.00% |

|

|

|

|

|

|

| 0.1% |

Source: CME Fedwatch

“While much depends on the policies preferred by new Fed chair Jerome Powell, who takes over from Janet Yellen in February, as well as the three new governors yet to be appointed by President Trump, the market may yet be too relaxed by putting such a low percentage chance on three increases this year.

“That is what the Fed outlined as its core scenario in December and it is possible to argue that firmer action is needed given how lively financial markets are becoming, with everything from stocks to commodities to Bitcoin to cannabis ETFs flying high.

“Asset-price inflation is every bit as dangerous as price hikes in the real world, as the market downturns and subsequent recessions of 2000-03 and 2007-09 showed and the Fed must be careful that it does not unleash market melt-up that leads to another market melt-down, so Powell has a tricky balance to strike in the year ahead.”

*Source: Challenger, Gray & Christmas job cuts survey