• An estimated 850,000 pension savers are invested in ‘lifestyling’ funds, which have fallen in value by 13% in the last two months

• These funds invest in long dated bonds, which have sold off heavily as a result of high inflation and interest rate rises

• People are shifted into these funds as they approach retirement in order to hedge against annuity rate movements

• But since the pension freedoms were introduced, only 10% of pension investors now buy an annuity

• Pension savers in their 50s or 60s are automatically defaulted into these funds as they approach retirement, but for many they are no longer fit for purpose

• The FCA’s default fund plans could be storing up problems for the future

Laith Khalaf, head of investment analysis at AJ Bell, comments:

“Lifestyling funds are a relic of a bygone era when pension rules basically meant that 90% of people bought an annuity at retirement. But these strategies are still being used today, when only 10% of people buy an annuity, thanks to the pension freedoms which were introduced in 2015. Pension default strategies that could have been set up decades ago, are only now starting to switch pension investors into these outdated funds.

“Many investors probably won’t be aware this is going on, but they could be sleepwalking into a bond market nightmare. That’s because high inflation and rising interest rates have led to a 13% fall in the value of these funds in the last two months. If these trends continue, things could get even worse from here. The logic behind lifestyling funds is that if they are falling in value, annuity rates will be rising to compensate. But that’s little comfort if you’re not going to buy an annuity with your pension.

“These funds will often be used in old workplace pension schemes run by insurers, and individual Stakeholder pensions. Many of these pension providers have now updated their current investment strategies to reflect the fact that few people are buying an annuity in today’s retirement market. But older pension plans are still ploughing on ahead with their default investment strategy of automatically shifting investors out of equities, and into these lifestyling funds which hedge annuity rate movements. For most pension investors, who aren’t going to buy an annuity, these funds are now totally unfit for purpose.

“Investors who are approaching retirement should definitely take a look under the bonnet of their pension plans to see what’s going on, and if any automatic switching is taking place, they can then make an informed judgement on whether it’s appropriate for them, based on what they’re going to do with their pension. If you think you might be invested in a lifestyling fund, check your latest valuation or speak to your pension provider. The funds in question will normally be called “long gilt” or “long corporate bond”, and will invest in long-dated government or corporate bonds. If you are going to buy an annuity with your pension, you might consider sticking with a lifestyling strategy. But if you aren’t, then you should give careful consideration to picking another type of fund to see you through to retirement, and beyond.”

What is a ‘lifestyling’ or ‘annuity-hedging’ fund

Lifestyling funds, or annuity-hedging funds, invest in long-dated government and corporate bonds, with the objective of hedging annuity rate movements. They work in this way because annuity rates are determined by bond yields, which move in the opposite direction to bond prices. So if you’re invested in a long dated bond fund, this should move in the opposite direction to annuity rates. Switching into one of these funds as you approach retirement can therefore be a good idea if you’re going to buy an annuity with your pension, because any falls in annuity rates are made up for by rises in the value of your lifestyle fund, and so your ultimate retirement income remains around the same. Conversely, if bond yields are on the up, your lifestyling fund might be falling in value, but annuity rates should be rising, again broadly maintaining your level of retirement income.

The impact of the Pension Freedoms

However, since the pension freedoms were introduced in 2015, few people now buy an annuity, choosing instead to draw their pension as cash, or invest it to produce an income. Prior to this liberating legislation, around 90% of retiring pension savers bought an annuity. But data from the FCA shows that in 2020/21, only 10% of retiring investors bought an annuity. So there has been a dramatic shift in the retirement market, which should have prompted a radical rethink in pre-retirement investment strategies. It did, and most providers have updated their pre-retirement de-risking options for new pension plans.

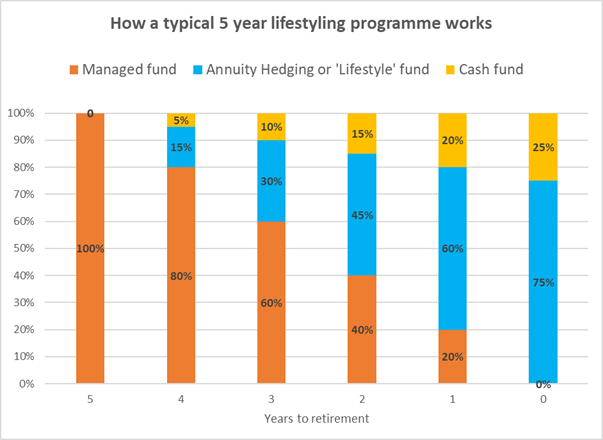

But problematically, pension plans that were set up ten, twenty, maybe even thirty years ago, can’t simply be switched across to a new investment strategy without the pension investor making an active decision to do so. Lifestyling is an automatic process, set in train many years ago, which starts switching pension savers out of a managed fund into an annuity hedging fund in the five to ten years before retirement (see example in the chart below).

We estimate there are around 850,000 pension investors who currently hold one of these lifestyling funds, based on the amount of money held in these funds (£15 billion, source: Morningstar), and the average Defined Contribution pension pot of 55 to 64 year olds (£35,000, source: ONS), and the simplifying assumption that the typical pension saver in one of these funds will have 50% of their pension pot invested. That number doesn’t include people who might have a lifestyling programme sitting patiently in the background, waiting for them to hit 55, or 60 years of age, and then starting to shift them into annuity-hedging funds.

Most of these people will have been automatically invested in a default strategy which includes lifestyling when they signed up to their pension many years ago, so few would have made an active decision to invest in this way. This strategy was most common in insurance company workplace personal pension plans, and individual Stakeholder pension plans (which effectively came with a government stamp of approval). The result is that many of the people invested in these annuity hedging funds probably don’t even know it, and they could be sleepwalking into a bond market sell off.

So why is this an issue now?

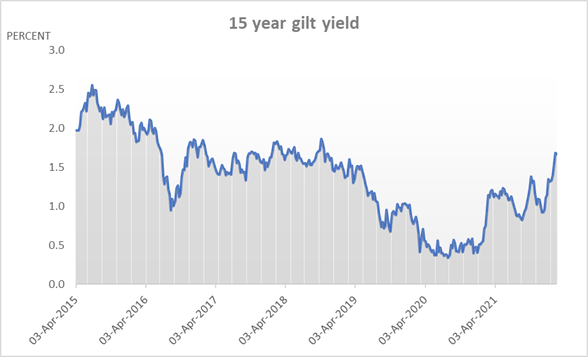

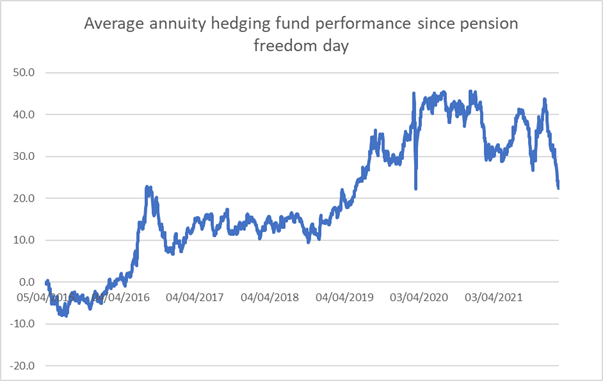

This hasn’t caused a big problem in the seven years since the Pension Freedoms were introduced because UK bond yields have fallen over this period, thanks to the Bank of England cutting interest rates in the wake of Brexit and the pandemic. In the five years after the pension freedoms were introduced in April 2015, the benchmark 15 year gilt yield fell from 2% to 0.5%, and as a result, the average lifestyle fund rose by 37% between April 2015 and April 2020 (Sources: Refinitiv and Morningstar). Few people were buying an annuity with their pension in this period, but no-one felt out of pocket because they were still banking a healthy return on their money.

Source: Refinitiv

But now the monetary policy backdrop is changing. Inflation is back, and the Bank of England is expected to raise rates aggressively this year. The result is that bond yields have been rising, and bond prices have been falling. In the last two months the 15 year gilt yield has risen from 1% to 1.7%, and the average lifestyle fund has fallen by 13% (Sources: Refinitiv and FE). Despite this recent rise in bond yields, they are still at historically low levels, and there could be more to come.

While savers aren’t likely to question an automatic investment strategy which produces a healthy bump in their pension pot just before retirement, they may be less forgiving if it delivers a significant loss. If this happens, the explanation that fund values may have fallen, but annuity rates have risen at the same time, probably won’t play well with the nine in ten pension savers that aren’t planning on buying an annuity. The veil of falling interest rates, which has masked the shortcomings of lifestyling strategies since the pension freedoms were introduced, may be starting to fall away.

Source: Morningstar

What can investors do?

Lifestyling strategies usually shift out of equities into annuity hedging funds over a period of five or ten years, and they do so automatically. Pension savers approaching retirement should therefore take stock of their position, and their retirement plans, and adjust their investment strategy accordingly.

Those who plan on buying an annuity might consider sticking with their lifestyling strategy, as it should hedge annuity rate movements. In a rising interest rate environment, they may be better off switching into cash or low risk multi-asset funds, but that doesn’t protect them if interest rates and bond yields fall back again. That looks unlikely, but it is possible, and could be prompted by a resurgence in the pandemic, or a conflict in Ukraine, or an unforeseen catalyst which derails the global economic recovery.

Those who plan to invest their pension for income might consider gradually switching their pension pot into income-producing funds, such as Multi-Asset Income funds, and Equity Income funds, which then provide the requisite amount of income needed in retirement.

Those who plan to go for growth with their pension and take capital gains might consider holding growth funds in their portfolio and simply carrying on with this investment strategy to, and through, their retirement date. This is a riskier approach and likely to be favoured by those who have high levels of pension saving, perhaps in the form of a defined benefit scheme, or assets like property, or simply a large defined contribution pension, or some combination of all of these.

In the three cases above, investors might also consider gradually building up to a cash pot of 25% of the value of their pension, if they intend to withdraw all of their tax-free lump sum at retirement.

Those who plan to take their pension as cash might consider gradually selling out of the market and switching into cash as they approach retirement, so as to avoid any falls in the value of their pot just as they are about to draw on it. This does open them up to inflation risk, but that really stems from the decision to encash the pension, rather than continue investing it for the long term, which could provide some measure of inflation protection.

The FCA’s default fund plans

Pension investors may follow one of these routes, or a combination, and so need to tailor their pre-retirement investment strategy based on their own individual plans. A single default investment strategy, selected by a pension provider for all its members, can’t hope to adequately cover the range of possible options now available to retiring pension investors. It’s therefore interesting that the FCA is currently consulting on introducing a standardised ‘default’ option for individual pension plans, and as part of that, mandating some form of ‘lifestyling’ or ‘de-risking’ as investors approach retirement.

The investment solutions provided by the industry in response would likely be a better fit for today’s retirement market than annuity hedging funds. But what annuity hedging funds demonstrate is the danger of setting an automatic investment strategy that takes place many years in the future, by which time it may be obsolete. Today’s best pre-retirement strategies may well look out-dated in twenty years, and if pension providers have to automatically shift investors into them nonetheless, that could just be storing up problems for the future. There simply isn’t a one-size fits all default solution that can compare to engaged investors making well-informed decisions based on their own circumstances, or seeking professional advice to do so.