• New research* suggests almost a third of NS&I savers are unaware of the impending rate cuts

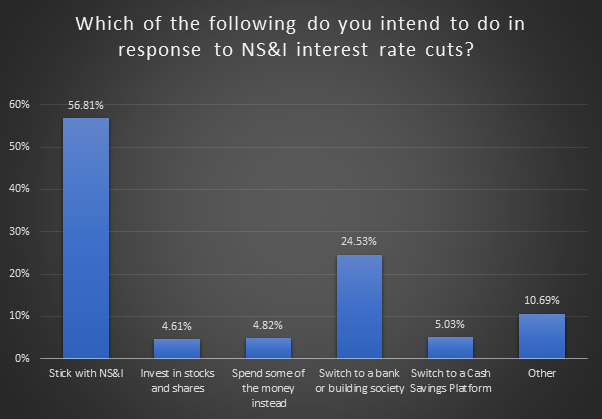

• 43% of NS&I savers intend to move their cash elsewhere

• 25% intend to switch to a bank or building society

• Has NS&I over-egged the pudding?

Almost a third of NS&I savers (31.7%) questioned said they were unaware of the rate cuts which are happening on 24th November.

Based on NS&I’s 25 million customer base, that could mean around 8 million customers who are currently unaware rates on their cash accounts are about to fall significantly.

(*Survey conducted by findoutnow on behalf of AJ Bell on 17.11.2020, with 500 respondents who are NS&I savers).

Laith Khalaf, Financial Analyst at the investment platform AJ Bell:

‘Millions of NS&I savers could be in for a nasty shock when they wake up and smell the swingeing rate cuts coming their way.

Until now, NS&I rates hadn’t been lowered to reflect the Bank of England’s rate cut in March, so their products were starting to stand out like a sore thumb in best buy tables.

The result has been a huge influx of money into NS&I, so it’s no surprise to see the organisation trying to turn the taps off, as they are extremely close to the £40 billion maximum the Treasury has asked them to raise this year.

Getting savers engaged with their cash accounts when rates are so low is incredibly difficult, so it’s credit to NS&I that over two thirds of their savers are in fact aware the cuts are coming.

A high proportion of NS&I savers said they were going to switch out to a new provider in response to the cuts, with only 57% saying they are going to stay put. While it remains to be seen whether intentions translate into action, that could mean large chunks of money leaving NS&I.

That perhaps reflects the depths of the cuts, and to some extent, is the purpose of them. While Premium Bonds still look competitive, around £25 billion of savings will now attract virtually nil interest, with rates being cut to 0.01% on Income Bonds and the Investment Account.

Banks and building societies look set to be the main beneficiaries of the NS&I exodus. Some cash will likely be spent, some invested in the stock market, and some will be switched to cash savings platforms, which pool the accounts of different banks and building societies in one place.

The high proportion of people intending to switch may well reflect the kind of saver who has been attracted to NS&I in recent months, during which they have maintained their rates while others cut. Savers who seek out providers at the top of the best buy tables tend to be active, and willing to ruthlessly move on when a better offer comes along.

NS&I will hope it hasn’t over-egged the pudding with the scale of its rate cuts. If too much money flies out the door, it could be forced into an awkward volte-face on rates in order to fulfil its funding commitments for this financial year.

NS&I is currently around £3 billion ahead of its target, and £8 billion ahead of the bare minimum it needs to raise for the Treasury, so it’s got some wriggle room. But our survey suggests a high proportion of savers are planning to vote with their feet.’

Source: findoutnow survey for AJ Bell 17/11/2020. Numbers do not add to 100% as respondents were asked to tick all that apply.

NS&I rate cuts and current best buys

NS&I is drastically cutting interest rates on the six variable rate, easy access products in the table below, which made up around £136 billion of the money held with NS&I as at 31st March 2020. £24.6 billion of cash is held in Income Bonds (£21.8 billion) and the Investment Account (£2.8 billion), where rates are being cut to virtually nil.

Premium Bonds now look like the only NS&I variable rate product offering a competitive rate of interest, though of course that is not shared equally, and savers may get more or less depending how lucky they are. Prizes are tax-free, which is an extra boost compared to normal savings accounts for anyone who pays tax on their savings.

|

Current NS&I AER |

New NS&I AER |

Moneyfacts best buy |

Extra annual interest switching to best buy on £50k |

|

|

Direct Saver |

1% |

0.15% |

0.75% |

£300 |

|

Investment Account |

0.80% |

0.01% |

0.75% |

£370 |

|

Income Bonds |

1.16% |

0.01% |

0.75% |

£370 |

|

Direct ISA |

0.90% |

0.10% |

0.65% |

£275 |

|

Junior ISA |

3.25% |

1.50% |

2.95% |

£145 (based on £10k) |

|

Premium Bonds |

1.40% |

1% |

0.75% |

-£125 |

Sources: NS&I, Moneyfacts best buy as at 16/11/2020. Current NS&I rates effective until 24th November 2020, when new rates become effective. For Premium Bonds the new rate becomes effective from the December monthly draw.

While 1% of interest here and there might not seem like a lot, on £50,000 of cash it adds up to hundreds of pounds a year, and much more when that’s compounded over time. So it’s always worth spending a bit of time to make sure your savings are working as hard as they can for you.

Fixed Rate Products

As well as cuts to the variable rate products, NS&I is also cutting rates on a range of fixed term products, specifically Guaranteed Income Bonds, Guaranteed Growth Bonds and Fixed Interest Saving Certificates, which are no longer on general sale. The cuts will be effective from 24th November where a customer’s product matures and is rolled over, but until maturity savers still get their existing rate, which is locked in for the whole period.

Again rates here will fall to uncompetitive levels. These products are no longer on general sale though, so if savers switch out, they can’t go back. That’s less of an issue for Guaranteed Growth and Guaranteed Income Bonds, but Fixed Interest Savings Certificates provide tax-free interest, which may provide an extra incentive to hang on to them for those who pay tax on their savings interest.

|

Current NS&I AER |

New NS&I AER |

Moneyfacts best buy |

|

|

Guaranteed growth bonds 1 year |

1.10% |

0.10% |

1.08% |

|

Guaranteed growth bonds 2 year |

1.20% |

0.15% |

1.26% |

|

Guaranteed growth bonds 3 year |

1.30% |

0.40% |

1.42% |

|

Guaranteed growth bonds 5 year |

1.65% |

0.55% |

1.50% |

|

Guaranteed income bonds 1 year |

1.06% |

0.06% |

1.08% |

|

Guaranteed income bonds 2 year |

1.16% |

0.11% |

1.26% |

|

Guaranteed income bonds 3 year |

1.26% |

0.36% |

1.42% |

|

Guaranteed income bonds 5 year |

1.61% |

0.51% |

1.50% |

|

Fixed Interest Savings Certificates 2 Year |

1.15% |

0.10% |

1.26% |

|

Fixed Interest Savings Certificates 5 Year |

1.60% |

0.50% |

1.50% |

Sources: NS&I, Moneyfacts best buy as at 16/11/2020. Current NS&I rates effective until 24th November 2020 when new rates become effective.

Overall the best course of action if you’re an NS&I saver depends on which kinds of product you’ve got and how much you value the security of having your money backed by the Treasury. In terms of security, it’s worth bearing in mind that the Financial Services Compensation Scheme covers up to £85,000 of losses per person in the unlikely event of their bank going bust.